America's "Healthcare" System Is Now a Structured Financial Skim/Scam

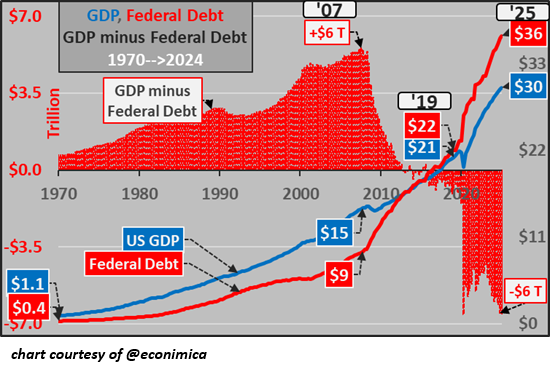

"Healthcare" grift, graft, fraud and financialized skims / scams will bankrupt the nation.

I've been writing about America's healthcare system for 18 years, emphasizing two enduring themes:

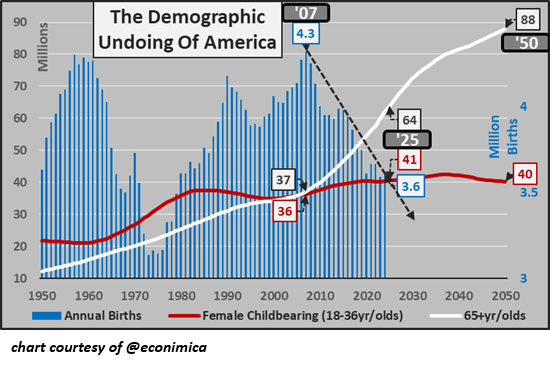

1) our lifestyle is unhealthy, with predictable consequences and 2) healthcare as it is currently configured will bankrupt the nation all by itself.

This recent article on how having a baby without complications now costs over $44,000 adds a third theme: the tragi-comic insanity and absurdity of the "healthcare" system that has been normalized, as if this is the only possible way to organize healthcare:

"And They Wonder Why The Birth Rate Is Declining": A Mother Went Viral For Revealing The Costs Of Being Pregnant In America:

Lastly, Kayla reveals that her baby received a bill, too, which added up to $12,761.30 without insurance. For their family of five now, the cost of insurance per month is $2,500 -- a nearly $400 increase from when they were just a family of four. "We're still waiting for him to process on our insurance," she explains, "so, for now, this is the cost without it."

One user said, "America's healthcare system is a joke... how does the newborn have a $12k bill?"

It's more than a joke--it's travesty of a mockery of a sham of a system that actually improves health. There's an even darker side of the picture--the takeover of the system by financiers and fraudsters--which truth be told is a redundancy.

We can now add a fourth theme: stripped of purposeful opacity, America's "healthcare" system is nothing more than a structured financial skim/scam. Before we dig into that, here are a few of the dozens of posts I've written on "healthcare" since 2008:

U.S. Lifestyle + "Healthcare" = Bankruptcy (June 19, 2008)

The "Impossible" Healthcare Solution: Go Back to Cash (July 29, 2009)

Why "Healthcare Reform" Is Not Reform, Part II (December 29, 2009)

Sickcare Will Bankrupt the Nation--And Soon (March 21, 2011)

How Healthcare Became Sickcare (March 18, 2022)

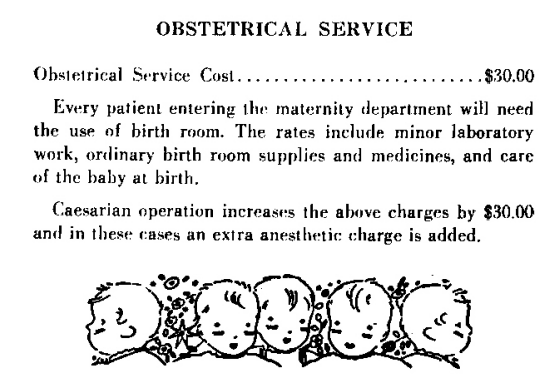

Let's start with what childbirth cost back when healthcare was paid in cash. Here are the costs of childbirth in 1952 at one of the finest hospitals on the West Coast, The Santa Monica Hospital: $30:

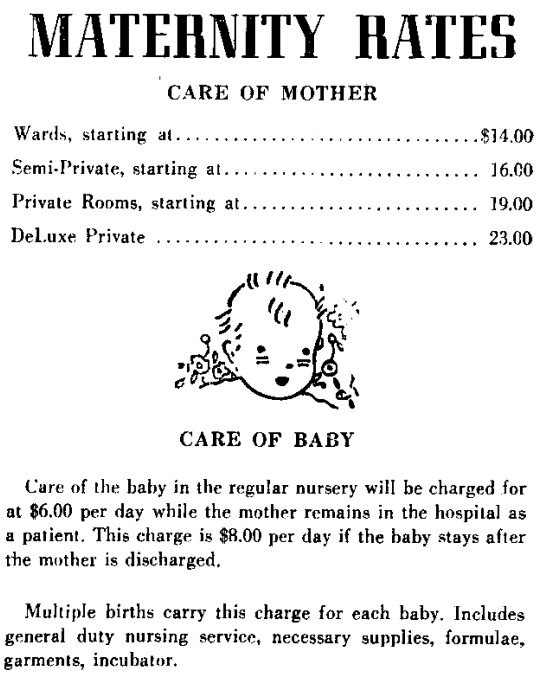

According to the BLS Inflation Calculator, $1 in 1952 is $12.13 today, so adjusted for inflation, the $30 fee to deliver a baby would be $363 today. Here are maternity rates from 1952:

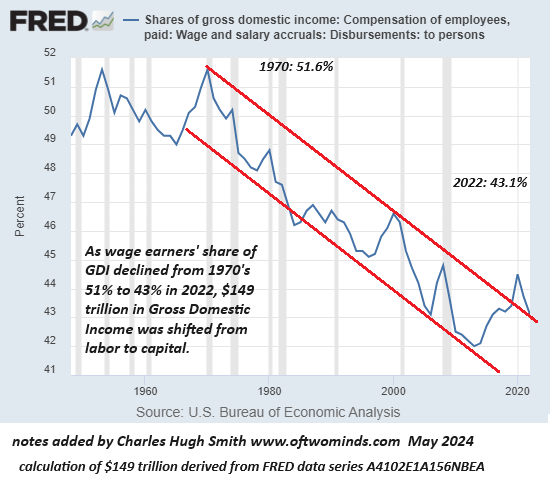

A private room was $19, or $230 in today's currency. OK, so we have fancier equipment now, more staff, etc., but really--does that explain what once cost less than $1,000 in today's money--paid in cash, no insurance--now costs $44,000? No. Here's why: structured financial skims/scams.

Dutch Rojas (@DutchRojas) is a go-to source for explaining the opaque way "healthcare" skims / scams siphon off hundreds of billions of taxpayer dollars. Consider these X posts:

Why is healthcare expensive?

You go to your doctor.

Same building, same service.

But now it's 3x the price, because they sold to a health system.

The secret?

A "facility fee" was added.

Medicare and commercial payers just hand it over.

It's not for better care.

It's for ownership.

Every consolidation deal is a bet against the patient and you're footing the bill.

And the politicians love every bit of it...

Provider Taxes: The Most Elegant Grift in American Healthcare

It's not a tax.

It's a laundering operation.

Here's how it works:

North Carolina's 'nonprofit' health systems are running a $40+ billion hedge fund operation disguised as healthcare.

They're extracting hundreds of millions in tax exemptions while paying CEOs tens of millions.

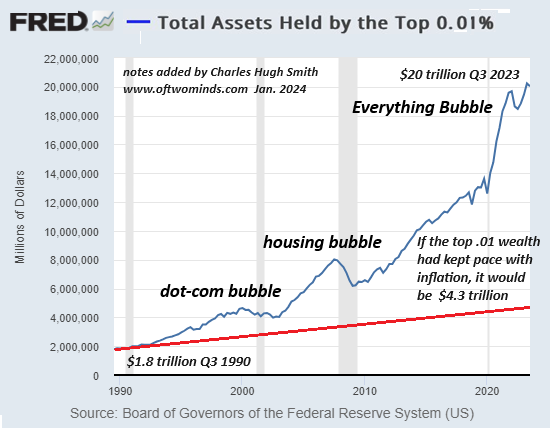

This is the largest wealth transfer scheme in the American healthcare system.

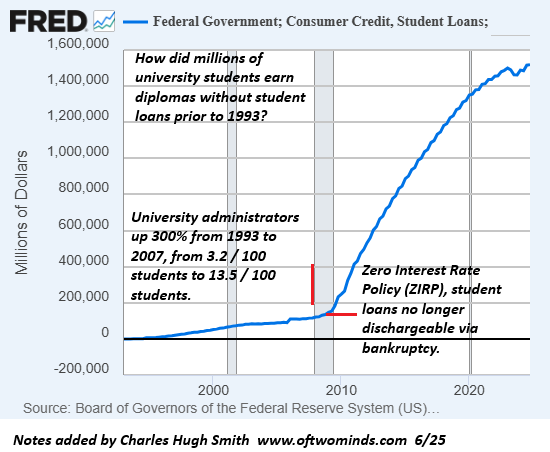

This doesn't even include outright Medicare/Medicaid fraud, overbilling, unnecessary tests, medications and procedures, and a nearly endless menu of other enrichment schemes passed off as "care." These billions go to the "owners," not the frontline healthcare providers / workers.

Lastly, let's consider a few charts. Here is my 2008 diagram of the building blocks of an unhealthy lifestyle:

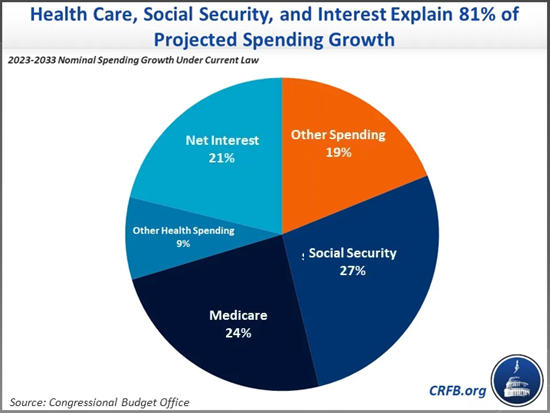

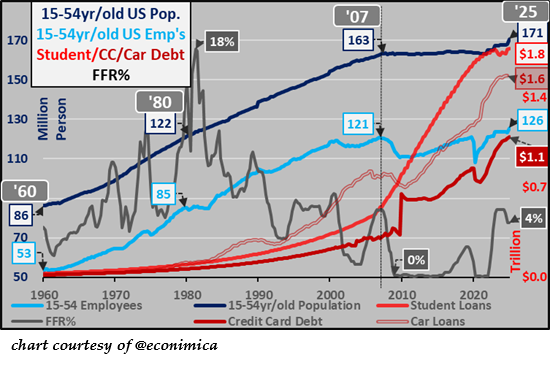

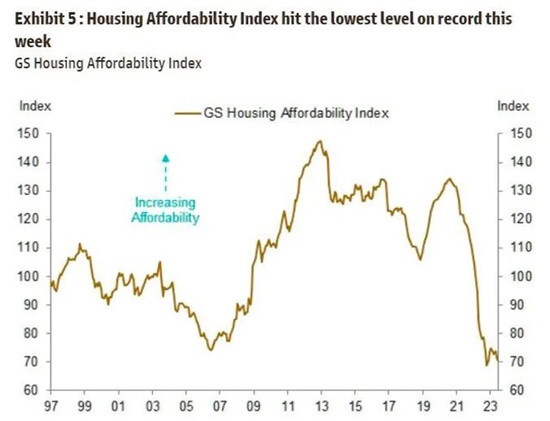

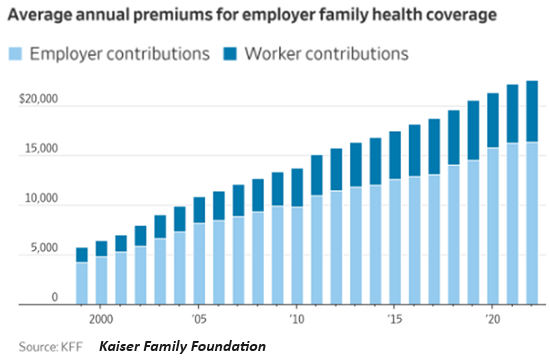

The cost of insurance continues rising, becoming ever more burdensome and ever more unaffordable:

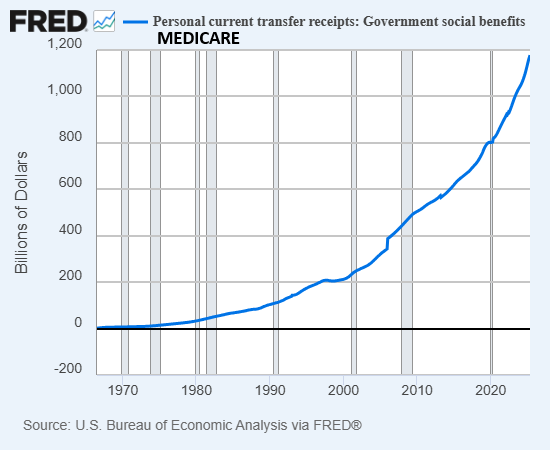

Yes, the number of retirees is expanding, but this parabolic rise in Medicare costs far exceeds the rise in the number of retirees.

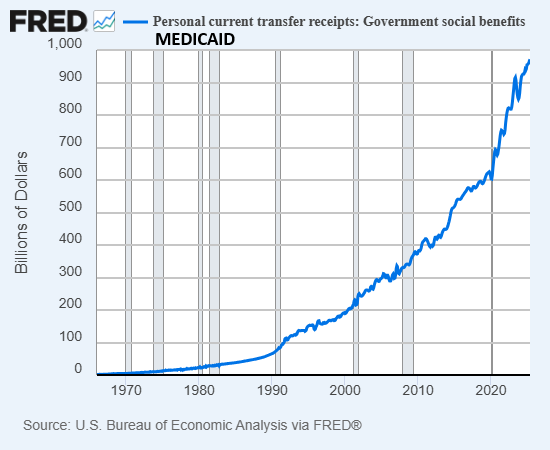

The same can be said of Medicaid.

"Healthcare" grift, graft, fraud and financialized skims / scams will bankrupt the nation. Thanks to the purposeful opacity of the complex funding streams, we can't even figure out what is actually "care" and what's just another skim / scam.

Our starting point should always be: this is not the only way we could organize "healthcare." We could have a rational, transparent, competitive and affordable system. But to get that, we first have to completely dismantle the current system, and everyone skimming billions will fight with all their billions in campaign contributions to stop that from ever happening. As a result, the nation will be bankrupted by greed.

Check out my new book Ultra-Processed Life and my new fiction/novels page.

Become

a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Ultra-Processed Life print $16, (Kindle $7.95, Hardcover $20 (129 pages, 2025) Read the Introduction and first chapter for free (PDF)

The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century print $16, (Kindle $6.95, Hardcover $24 (215 pages, 2024) Read the Introduction and first chapter for free (PDF)

Self-Reliance in the 21st Century print $15, (Kindle $6.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $15 print, $6.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $6.95, print $16, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $6.95, print $15, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $3.95, print $12, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $3.95 Kindle, $12 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Carolyn B. ($70), for your exceedingly generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Enoch E. ($7/month), for your marvelously generous subscription to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, Daniel T. ($75), for your superbly generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, David P. ($70), for your splendidly generous subscription to this site -- I am greatly honored by your support and readership. |