10 Geopolitical / Financial Risks to the Global Economy

Perhaps the most apt metaphor to describe the decade ahead is that investors, consumers and taxpayers will all be rafting whitewater rapids with ever-briefer stretches of calm.

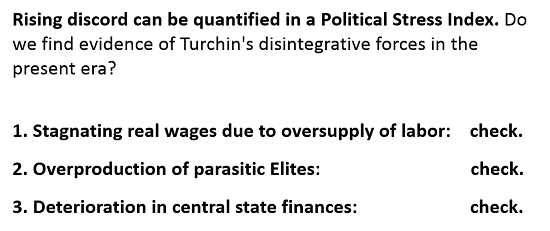

Geopolitical / financial risks are proliferating and becoming more difficult to predict or hedge for a very basic reason: the era of global integration and accord has ended and the era of global disintegration and discord is heating up. In historian Peter Turchin's terminology, when everyone finds reasons to cooperate, the result is an era of accord; when everyone finds reasons not to cooperate, the result is an era of discord.

Beneath the chaotic swirl of complex dynamics and risk, two core drivers emerge: de-globalization and de-financialization.

The 30-year era of increasing globalization has reversed, reducing the influence of markets and increasing the influence of national security. Where the globalization era led to global trade agreements which served at least a few of every participants' core interests, the de-globalization era will be characterized by fragmentation and deals being cut between nations outside of traditional alliances and ideological camps.

In the neoliberal worldview, markets are solutions to virtually every problem: open up markets and let price discovery and innovations solve all problems. This construct is ideologically appealing, but in the real world, markets generated extremely risky supply-chain dependencies on unreliable offshore sources: yes, these dependencies were efficient and profitable, but when things fall apart, they cause dominoes to fall far beyond what "markets" anticipated or could hedge.

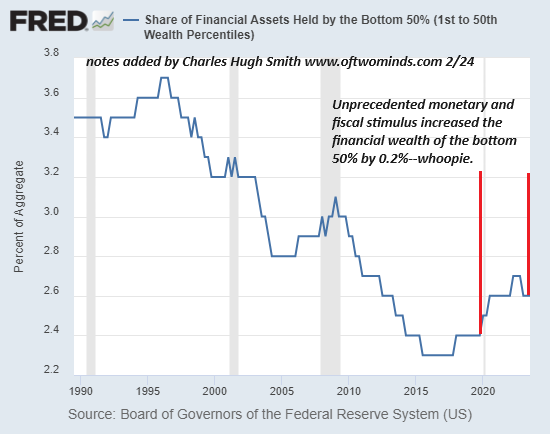

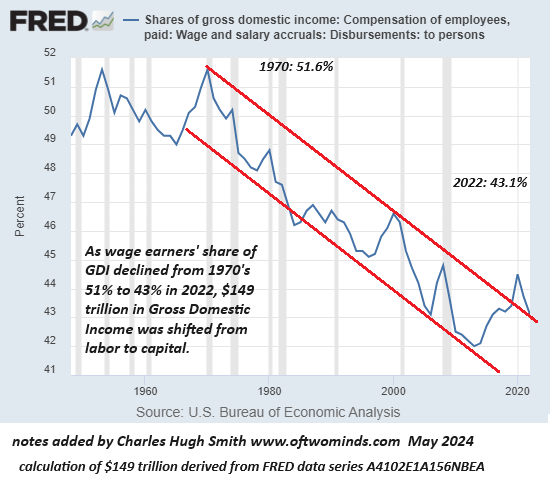

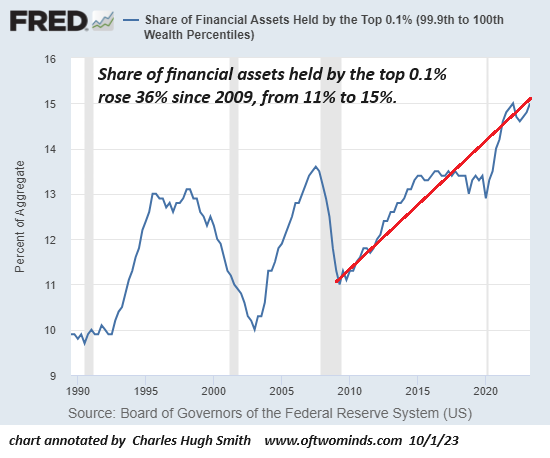

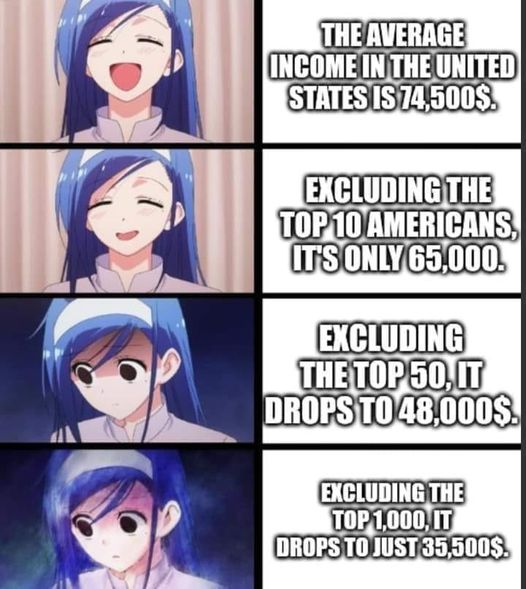

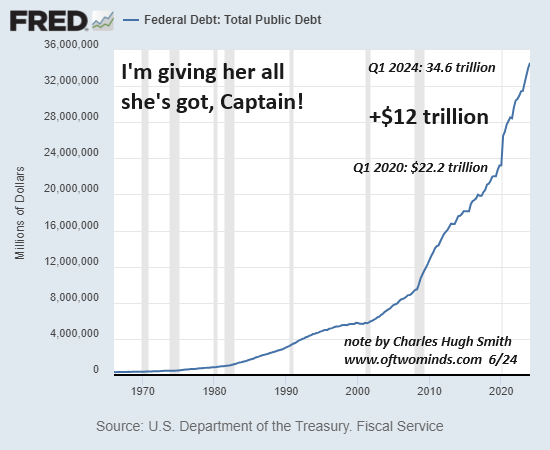

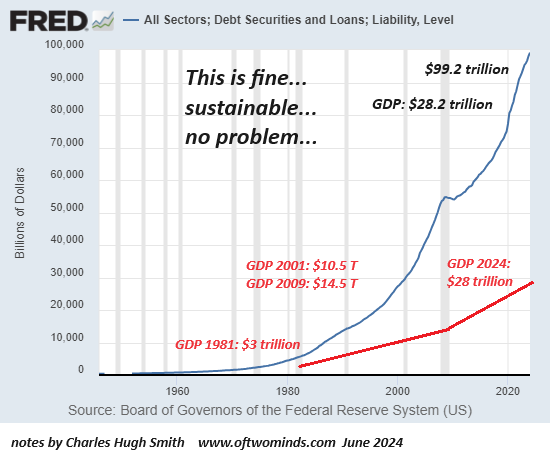

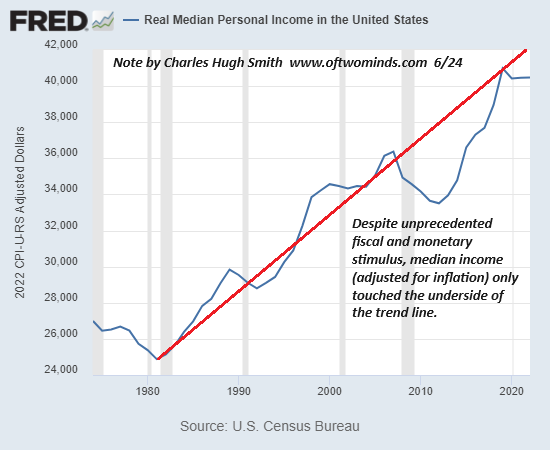

The 50-year era of increasing financialization has also reversed. In a nutshell, financialization optimized capital at the expense of labor / wage earners, and optimized speculation via the vast expansion of credit and leverage, enabling finance to commoditize virtually everything in the global economy: labor, capital, goods, services and yes, even risk.

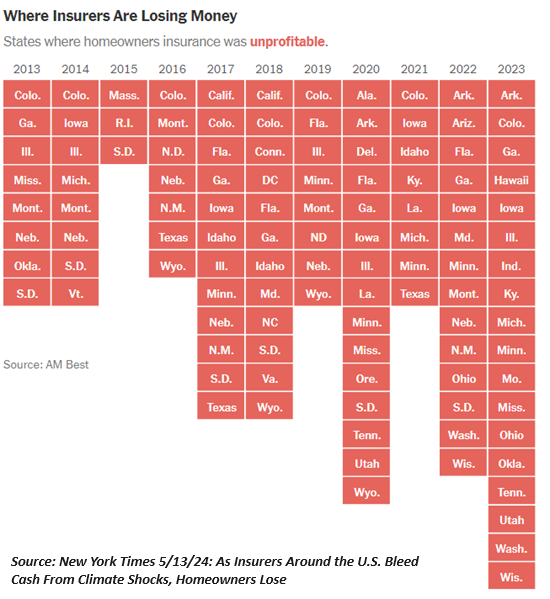

But commoditized risk that can be hedged only includes the risks that are visible and known. When extremes become more extreme, the potential for risk to escape the neatly fenced corral of hedged risk increases in ways that cannot be quantified and hedged.

I tend to think many observers focus too narrowly on risks arising from financial crises, for example a crisis in the multi-trillion dollar shadowy derivatives market that could cascade as holders of derivative contracts with claims on underlying collateral (for example, the homes underlying mortgages in a mortgage-backed security) start seizing the collateralized assets embedded in the derivatives chain.

While I make no claim to understanding "The Great Taking" scenario and cannot vouch for its accuracy, the basic idea is well-established: derivatives (such as CLOs and CDOs, as well as many even more exotic concoctions) can include claims on the underlying collateral of debt-based assets such as homes or vehicles.

The risk few seem to be discussing is not the seizure itself but the political firestorm any such seizure would ignite. The public has tolerated a stinking mass of self-serving bailouts and insider dealings under the threat of "if we don't do this, the entire system collapses in a heap" for the past 15 years, but their patience with financier stripmining may run out more quickly than the political elites imagine.

History suggests that social revolutions often start spontaneously from an apparently trivial event: the deadwood of a corrupt system rigged to funnel asymmetric rewards to the few at the expense of the many finally catches fire, and quickly becomes a conflagration.

While many commentators have noted China continues reducing its holdings of US Treasuries (UST) and the general trend of de-dollarization, i.e. offloading Treasuries and seeking payment mechanisms that do not include the US dollar (USD), few seem to ponder what risks might arise in other currency flows, for example, the capital sloshing around the global economy as Direct Foreign Investment (FDI), money that flows into an economy as investments in assets such as manufacturing, mining, housing, tourism, etc.

Just as capital flowing in or out of sovereign bonds reflects the interests of each participating nation, so too do FDI investment flows and the sales and purchases of Strategically Significant Commodities.

I would characterize this vast reshuffling of global capital flows as a direct consequence of two factors:

1. The ascendence of national security over market incentives (i.e. profits, mercantilist exports, etc.)

2. The fragmentation of broad trade agreements in favor of special deals with trading partners that include not just tariffs but access to Strategically Significant Commodities and investment capital flows.

In other words, trade is no longer about opening new markets for mercantilist exports and parking surplus dollars in Treasuries, it's about securing essential commodities and capital flows in exchange for access to supply chains and financial markets.

The mercantilist era has ended: so-called free trade (there is no such thing) that created critical national-security-related dependencies on frenemies is now something to avoid and reverse at all costs. Mercantilist nations that have depended on increasing exports as the source of their economic growth will find markets restricted as relocalization and glocalisation become priorities. (This includes China, Germany, Japan and other export-dependent economies.)

We can foresee deals that include access to commodities, guarantees to buy sovereign bonds, opening previously closed sectors of mercantilist economies and access to direct investment, not just trade and tariffs. In other words, the fragmentation of global trade opens the door to deals brokered between individual nations, tailored to their own interests, that cover not just interests in trade per se but in securing commodities, essentials and capital flows.

Globalisation is not dead, but it is fading: 'glocalisation' is becoming the new mantra.

Risk also rises when established processes break down as multiple crises emerge and reinforce each other--what's known as polycrisis. When established mechanisms no longer resolve crises or conflicts, then leaders will naturally be tempted to try ever more extreme measures to regain control (or the illusion of control).

Every leader is prone to miscalculation, but authoritarian regimes with highly concentrated nodes of decision-making are more prone to making catastrophically bad decisions because they've suppressed dissent and open debate as threats to the regime's political and narrative control.

The global trend toward authoritarianism concentrates decision-making in the hands of the few, increasing the risks of fatal misjudgments or miscalculations.

Amidst a disconcertingly expanding universe of risks, Richard Bonugli and I discuss these ten which were assembled by the consortium at CedarOwl.

CedarOwl's Table of Geo-Political Investor Risks. This graphic can be understood as a risk matrix. (My own list of 10 risks would be different, of course, but this is a worthy place to start.)

Podcast: 10 Geopolitical / Financial Risks to the Global Economy:

1. Financiers Seizing Collateral in a Derivatives Crisis, a.k.a. "The Great Taking"

2. Cyber attacks

3. Tariff wars

4. Confiscation of other nation's financial assets

5. Selling / Boycott of US Treasuries

6. Imposition of Central Bank Digital Currencies (CBDCs)

7. Russia's ban of uranium exports to the West

8. Restrictions on Strategically Significant Commodities

9. Private cryptocurrencies forcibly folded into CBDCs

10. Escalation of Ukraine war

Where does our risk assessment take us? Perhaps the most apt metaphor to describe the decade ahead is that investors, consumers and taxpayers will all be rafting whitewater rapids with ever-briefer stretches of calm.

So what do we do as individuals? De-risk our lives as much as possible and focus on increasing our problem-solving skills. This is my definition of

Self-Reliance.

New Podcast: 10 Geopolitical / Financial Risks to the Global Economy

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, John C. ($70), for your splendidly generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Federico T. ($70), for your magnificently generous subscription to this site -- I am greatly honored by your steadfast support and readership. |

|

|

Thank you, Jay ($7/month), for your monumentally generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Aaron W. ($70), for your superbly generous subscription to this site -- I am greatly honored by your support and readership. |