The System Is Busy Cannibalizing Itself

As the word suggests, cannibalism won't end well for those consumed by the infinitely insatiable few.

Cannibalize is an interesting word. It is a remarkably graphic way to describe the self-inflicted

destruction of a system by stripping previously functional subsystems to sustain the illusion of

system functionality.

Here are some examples.

An Air Force which routinely posts photos of its impressive fleet of 100 aircraft has been cannibalizing parts

from 80 aircraft to keep 20 flying. This maintains the useful illusion that all 100 aircraft are available for

combat when only 20% are functional, and most of those only minimally so.

An enterprise maintains a substantial cash position even as it loses money every quarter

by quietly selling off its most valuable assets. This maintains the illusion of financial strength even as

the enterprise is being hollowed out.

The system--whatever you choose to call it--is busy cannibalizing itself to the point of collapse.

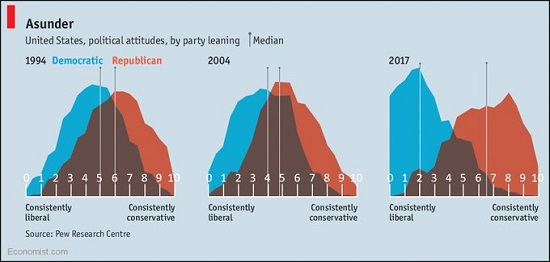

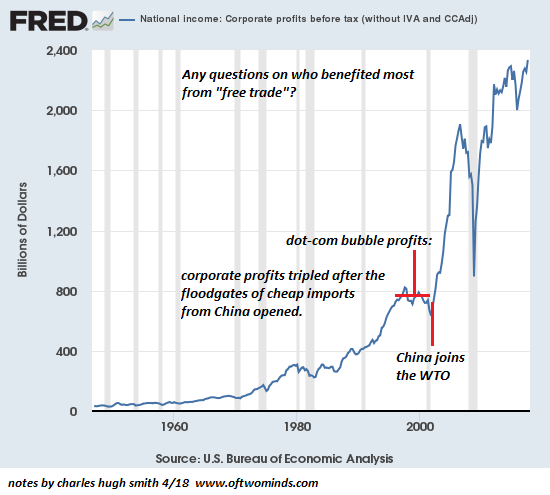

Neoliberal State Capitalism is a pretty accurate description of every major global player's system

because all seek to benefit from the expansion of markets (Neoliberal Capitalism) and financial instruments (Finance Capitalism),

and control these markets and instruments to benefit the few in power at the expense of everyone else

(state Capitalism).

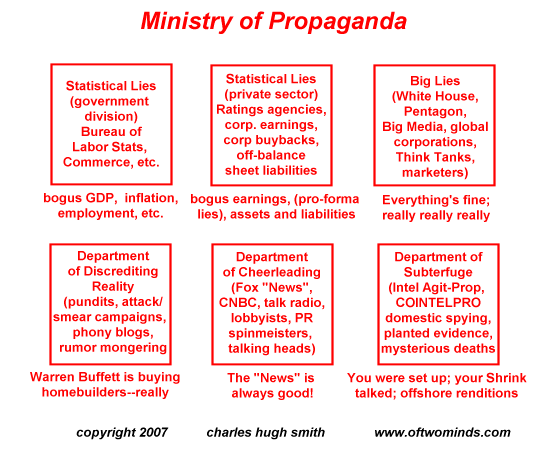

Turning transparent, open markets into controlled, exploitable "markets" is the ultimate cannibalization of

equally-open-to-all market capitalism which is the foundation of the productive distribution of opportunity.

Turning small-scale, localized finance into centralized / globalized hyper-financialization cannibalizes

finance to benefit the few with unlimited access to credit, leverage and monopoly. First you borrow vast

sums at low rates of interest that are inaccessible to mere mortals, take a corporation private, indebt the

company and use the funds to accumulate mountains of derivatives that leverage the debt 10-fold or even 100-fold,

then take the corporation public again, goose the stock and then cash out all the leveraged gains.

The newly public company has been stripmined of core assets and burdened by debt. The financiers cannibalized

the corporation to benefit themselves at the expense of everyone else with a stake in the business and the

future viability of the enterprise.

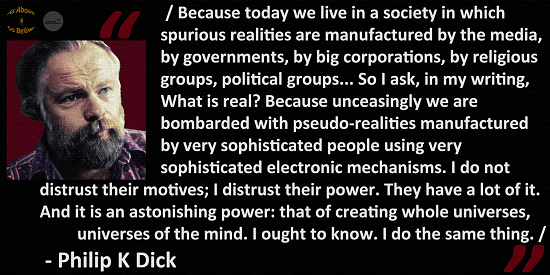

This cannibalization is not restricted to the financial realm. True virtue--honesty, trustworthiness,

the willingness to accept self-sacrifice for the greater good--has been reduced to ashes behind a glossy,

fraudulent facade of virtue-signaling, a facade that masks the cannibalization of the system to benefit

the self-congratulatory, hypocritical few at the expense of the many.

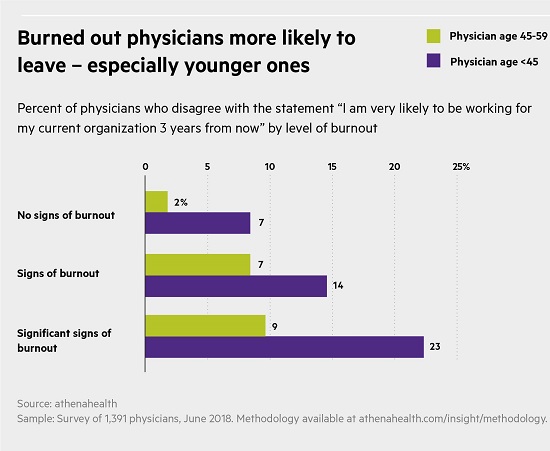

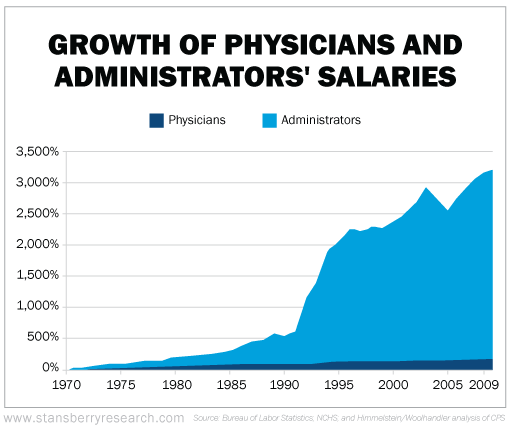

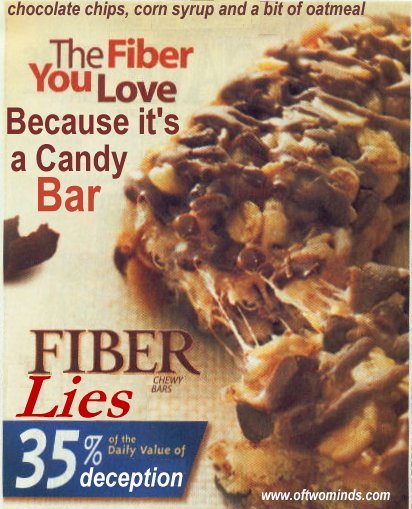

Health has also been cannibalized to maximize the private gains of the few at the expense of the many.

If we define food as natural products high in nutritional content then very little of what's

being presented as "food" actually qualifies as food because its nutritional content is somewhere between abysmally low

and non-existent.

Highly processed products are simulacra of food that hijack our hardwired pleasure responses to

heavy concentrations of salt, sweets, fat and spice and crunchy/chewy mouthfeel. The nutritional content

of these products is so low and the fat-salt-sugar content so high that they are severely damaging to health

on multiple levels.

The unwary consumer who stuffs themselves with these simulacra of food (shall we call it "fud"?) feels full even

as their body and brain are starved for real nutritional content and real-food fiber.

Everywhere we look, we find a massive cannibalization effort behind every phony facade, a cannibalization

that hollows out the functionality and adaptability of core systems to benefit the few at the expense of the many.

Virtue-signaling isn't virtue, cannibalized aircraft can't fly, cannibalized enterprises are zombies awaiting

incineration and those cannibalized by the "fud" and healthcare industries cannot become healthy because

garbage in, garbage out.

As the word suggests, cannibalism won't end well for those consumed by the infinitely insatiable few.

It won't even end well for the infinitely insatiable few because they're consuming the last of their prey

so voraciously.

In the meantime, enjoy the self-destructive charms of cannibalized functionality and value.

Recent podcasts/videos:

Roundtable Insight: Charles Hugh Smith on the Insanity of Central Banks in Addressing Inflation (38 min.)

My new book is now available at a 10% discount this month:

When You Can't Go On: Burnout, Reckoning and Renewal.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

My recent books:

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake

$1.29 Kindle, $8.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Mark S. ($5/month), for your monumentally generous pledge to this site -- I am greatly honored by your support and readership. |

Thank you, Rick L. ($10/month), for your outrageously generous pledge to this site -- I am greatly honored by your steadfast support and readership. |