The Great Unwinding: Is There Any Way to Come Out Ahead?

History suggests being wary of the "strong buys" at $45 when the eventual bottom is $4.

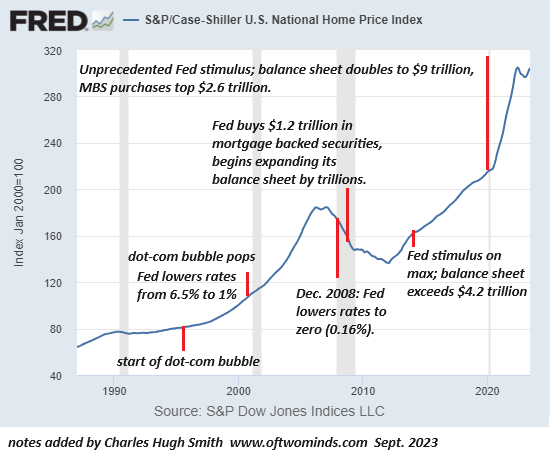

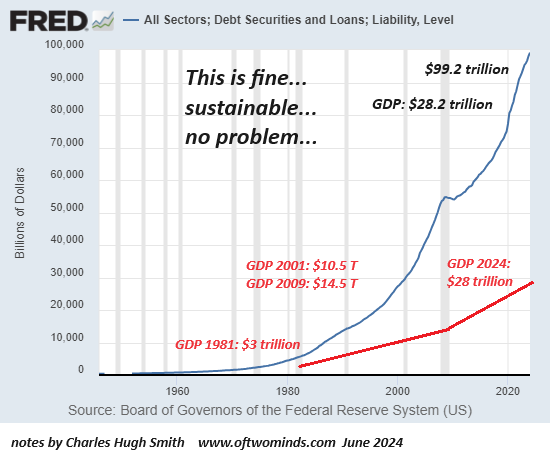

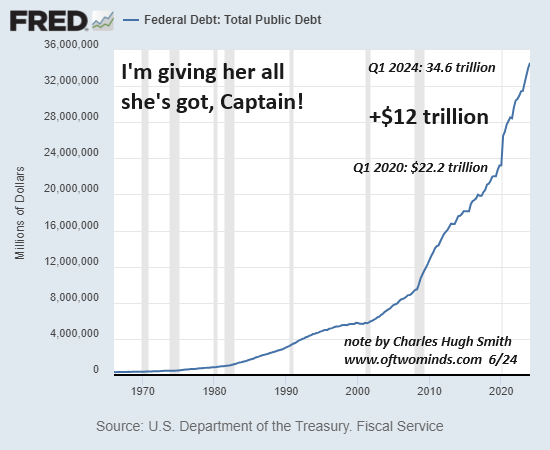

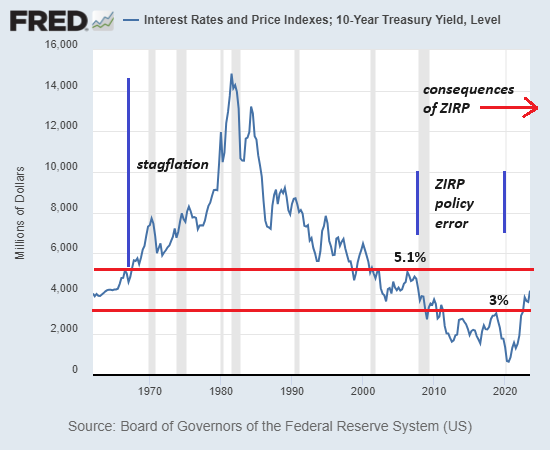

In response to my chart-fest post The Rollercoaster Ride Ahead: 15 Years of Extreme Distortions Will Be Unwound, readers asked: OK, so what can I do in response? That's the right question, for passively awaiting the wave to wash over us and then scrambling for higher ground is a high-risk strategy.

Let's start with three stipulations: 1) this is not investment advice; everything here is an observation based on history or my personal experiences after previous bubbles have popped; 2) there are no easy answers--none, and 3) my last three books can be viewed as a trilogy describing macro and individual responses to the Great Unwinding. I'll post links to the free chapters at the end of this post. The point being that I've pondered this question for many years.

Do I have all the answers? No. Nobody does. All we can assemble is a coherent response based on the lessons of history and system dynamics: what's fragile, risky and undependable and what's lower risk and more resilient.

Since no response is easy, we're talking about degrees of difficulty and what's within reach for each of us. We all have limits of experience, location, skills, capital, networks and so on. Therefore there is no "one size fits all" template that's going to work for everyone. The whole point of my book on Self-Reliance is that we each have to plan our own responses; we can't just follow somebody else's plan.

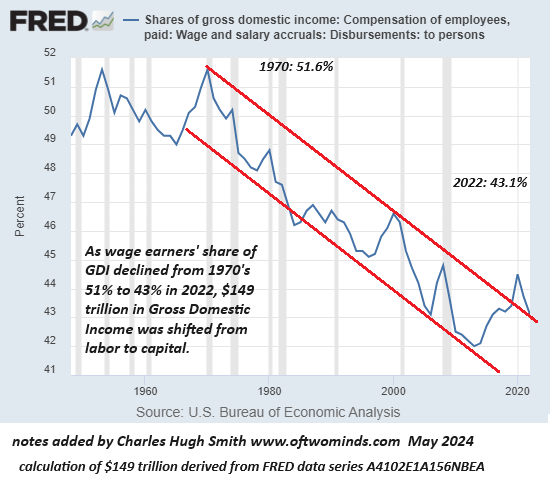

There's a great divide between what Americans want / expect and what's realistic.

The average American feels they need to earn over $180,000 to live comfortably, survey shows The survey also found that only 6% of US adults make $186,000 or more, while the median family income is between $51,500 and $86,000. In other words, everyone feels they'd be OK if they joined the top 6%, meanwhile those households earning $180,000 are feeling that they need to earn $300,000 to be comfortable.

If you and your spouse / partner can skim off $300,000 or more annually, go for it. In terms of risk management, it might be prudent to assume one of you loses your job at some point, so figuring out how to live on $100,000 now rather than later makes sense.

Many readers report that they've already fashioned a low-cost, resilient lifestyle, generally by living in a lower cost rural locale with cheaper housing, paying off debt, doing their own repairs and maintenance on homes and vehicles, growing some of their own food and finding like-minded people in the community to share/work with.

Living Well on Less Than $30,000 a Year--One American Family's Story.

Establishing a low-cost lifestyle demands sacrifices, many of which are "impossible" or out of reach in the current zeitgeist: the jobs and excitement are in cities and suburbs that are unaffordable:

Starter Homes Cost At Least $1 Million In 117 California Cities.

Learning how to repair, maintain, grow, cook, bake and build also takes time, effort and sacrifice. The transition from consumer to producer is not easy.

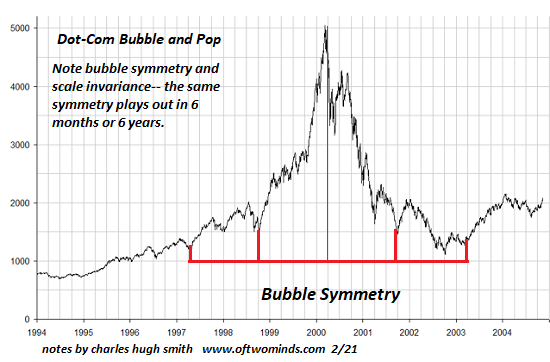

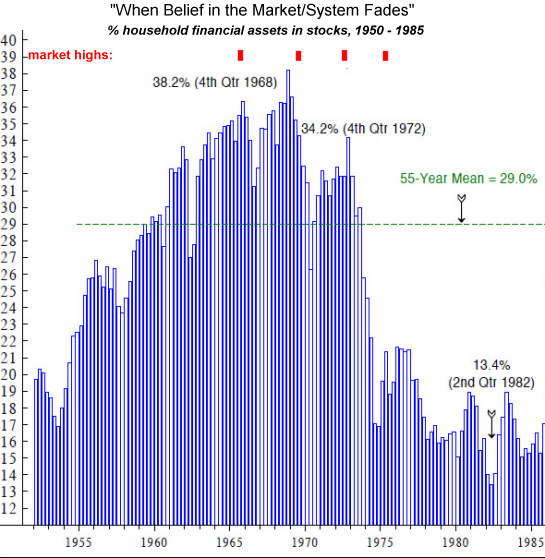

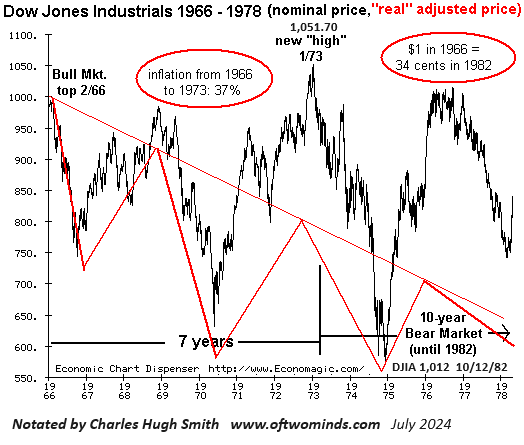

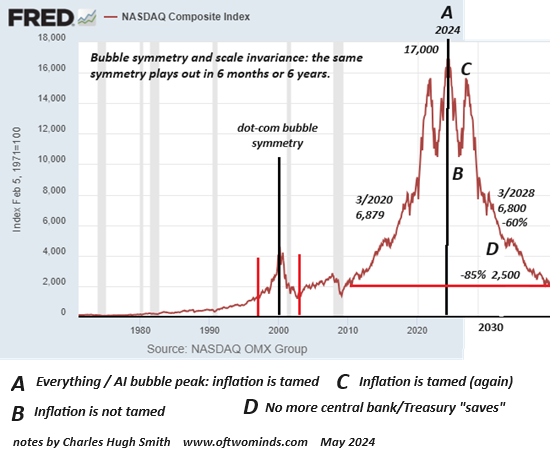

It's been a long time since Americans experienced a "real recession": the last "real recession" was in 1981-82, over 40 years ago. Since then, recessions have been brief due to unprecedented bailouts and stimulus. The returns on bailouts and stimulus have diminished, and expecting the same tricks to work like magic again is, well, magical thinking. Things have changed, and as I've outlined, it may be less like 2000 or 2009 and more like 1973: nine years of turmoil and inflation that refuses to return to zero.

The biblical seven abundant years, seven lean years comes to mind. Humans predictably respond to abundance by gleefully squandering what's plentiful in the good times, and then frugally hoarding whatever is left when the lean times kick in. Frugality is common-sense: waste nothing, need less, get serious about your Plan B and Plan C.

Readers ask: are there safe havens for my capital? There are certainly many claims made about safe havens, and I can only speak from my experience of bubbles popping over the past 50 years. The current bubble is unique in being an Everything Bubble, in which traditional safe-haven asset classes have already been front-run by the smart money.

In my experience, every asset goes down when massive credit-asset bubbles pop as the "good" assets get sold to cover margin calls as "bad" assets plummet and debts have to be serviced / paid down. That's the downside of a financial system that is completely dependent on debt and leverage for its survival: the asset valuations can collapse but the debts remain and can only be cleared by bankruptcy / liquidation / insolvency.

Assets drop to levels that are considered "impossible" at the top of the bubble. This is the mindset of bubbles: the current valuations are entirely rational, and history says they'll only move higher over time. This is how stocks that fell from $60 to $45 got recommended as a "strong buy" and then eventually bottomed at $4. Skyscrapers were sold for the value of their elevators in the Great Depression.

Earning 4% on cash looks pretty good when others playing "catch the falling knife" have lost 40% of their capital. Patience tends to pay off as bubbles pop and furious counter-rallies tempt bottom-fishers and buy-the-dippers. If history is any guide, bubbles take a few years to completely deflate, as the speculative frenzy takes a long time to dissipate as gamblers' capital and desire to bet are whittled away.

The cliche is cash is king in asset-bubble deflations, and there's a reason for this. Cash may lose some purchasing power due to inflation, but it's earning some income to offset inflation. Every other asset that soared in the bubble is exposed to the selling that comes from having to pay down debt, unwind leverage and get out now before I lose even more money.

The risks of patiently waiting for the bubble to completely deflate are low compared to the risks of trying to rotate in and out of deflating assets ahead of the bots and smart money, who are masters of juicing manic counter-rallies to suck in the impatient and speculators who are overly anxious to "buy the dip."

Note that Wall Street never recommends frugally piling up cash for a few years, as that generates no income for Wall Street, which thrives off the herd busily churning away capital chasing the latest hot rotation into bat guano futures, cobalt mines in Lower Slobovia, the Hydrogen economy, AI-powered robot pets, and so on. Maybe fortunes will be minted, maybe not, but staying out of the casino and waiting for the bottom, when everyone has given up, is never going to be touted by anyone in the casino.

Recall that it doesn't matter what the "market" deems as the "fair price" for productive real-world assets. If my house is "worth" $1,000 or $1 million, it still provides shelter. If a homestead produces 1,000 pounds of nutritious food a year, it doesn't matter whether the "market value" of the land is $1,000 or $1 million. That only matters if we're speculating or leveraging debt. If we're only interested in the use value, then the "market" gyrations are of zero interest.

What's the "real value" of anything? That depends. My wife just bought a pair of almost-new Merrell brand shoes that retail for $100 for $2 at a thrift store. For somebody, the shoes were worth $100. Now they're worth a few dollars.

Keep in mind health is the only real wealth. Once health is lost, even $100 million can't restore it.

Everyone's a genius in a bubble, but over time, few survive even five years of volatility. It may look easy to have caught the highs and lows of the 1970s, but few managed to do so.

History suggests being wary of the "strong buys" at $45 when the eventual bottom is $4. This is of course "impossible." Everyone thought that in 2000 and 2008, too, and it's the dominant mindset once again.

The opportunities lie ahead--far ahead. There is much to be said for this simple strategy: get lean, get frugal, pay off debt, save cash, get your Plans B and C in order, learn as much as you can to increase what you can do in the real world for yourself and your household, lower your exposure to non-linear disruptions and systemic risks beyond your control, turn a deaf ear to the touts and stay out of the casino.

Here are the links to the free chapters of my books on anti-fragility and self-reliance:

Self-Reliance in the 21st Century, excerpts

Burnout, Reckoning and Renewal, excerpts

Global Crisis, National Renewal, Chapter One

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Michael ($7/month), for your marvelously generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Marianne ($7/month), for your admirably generous subscription to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, Eric K. ($7/month), for your monumentally generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, JBird ($70), for your superbly generous subscription to this site -- I am greatly honored by your support and readership. |