It's a New Era

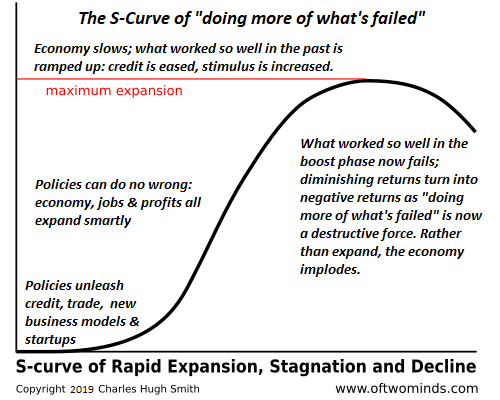

This dynamic--making problems much worse by forcing more of whatever worked in the previous era into a saturated,

increasing unstable new era--receives little attention or understanding.

Eras may last decades, and only those who've lived long enough to recall previous eras have experienced the

transition from one era to the next.

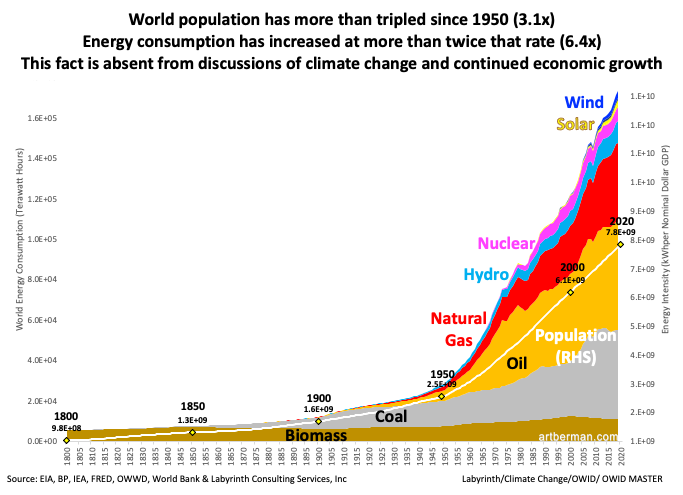

The era of financialization, globalization and low-cost, abundant oil/natural gas began over 40 years ago in 1981.

The era of digital / Internet technologies took off about 30 years ago. All of these dynamics accelerated in the early

2000s, roughly 20 years ago.

Only those 60 and older experienced working in a previous era (pre-1981).

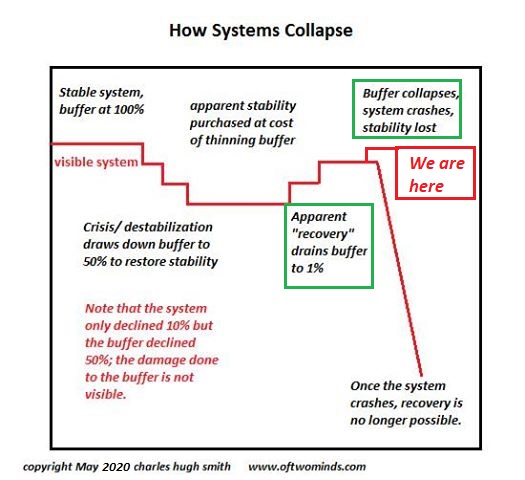

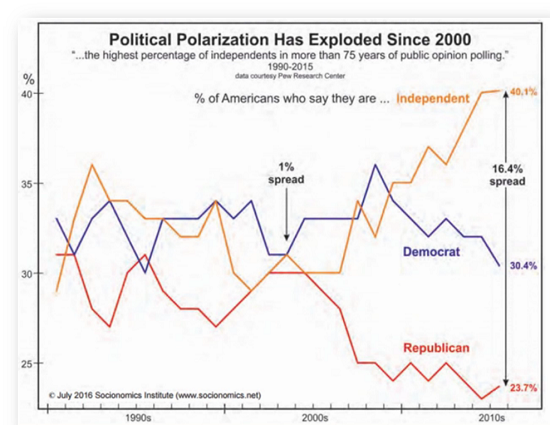

All of these dynamics are entering a phase of nonlinear turbulence as the changes are outpacing these

highly streamlined / optimized systems' ability to self-correct.

This nonlinear instability is being accelerated by doing more of what worked in the previous era, in the mistaken belief

that the 2020s are simply an extension of the eras that began 40 and 30 years ago.

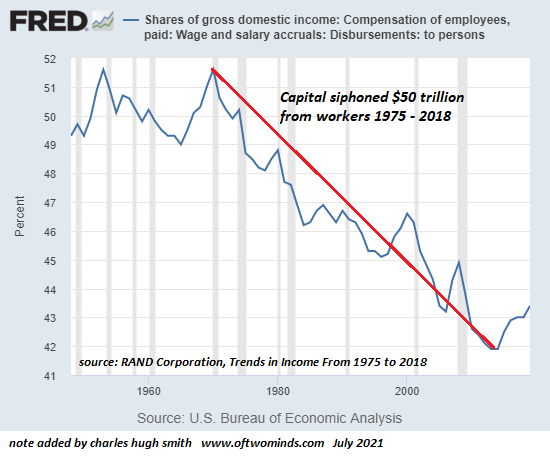

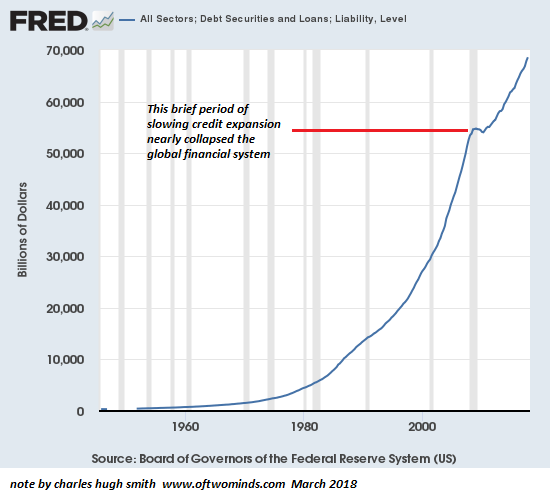

The fixes that worked in the past won't resolve the nonlinear instability because all these dynamics have reached

saturation: adding more debt no longer generates organic expansion of productivity, all it does is inflate an even

larger and more unstable credit-asset bubble.

Globalization has been optimized to the point of saturation: the potential downsides to national security outweigh

any remaining marginal gains in corporate profitability.

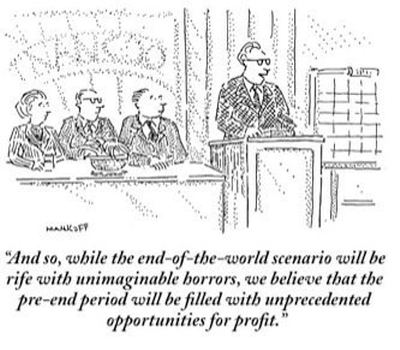

Financialization has so distorted the economy that gambling on useless speculations is now viewed as the best (or

only) way to get ahead.

When a system has absorbed all it can absorb, adding more is just a waste of resources.

We've entered a new era, and so the fixes and incentives that worked in the past 40 years no longer work.

The idea that the past 30 years were not a permanent era but an anomaly that's come to an end doesn't compute

for everyone who has only experienced the "glorious 30" years of cheap energy, soaring assets and falling prices

due to hyper-globalization and hyper-financialization.

The idea that this new era may evolve unpredictably is also anathema to a technocratic culture and economy that

prides itself on forecasting and controlling everything with credit and money.

The previous 40 years of material abundance has nurtured a belief that the solution to any scarcity is to create

more money, as some of this new money will inevitably flow into eliminating the scarcity.

The idea that some scarcities cannot be fixed by creating more money doesn't compute.

It may turn out that all the lessons we learned in the past 40 years will not only be useless in this new era,

they will be disastrously counter-productive.

Their unparalleled success for decades may blind us to the power of previous solutions to make our problems worse

than they would have been had we recognized the new era for what it is rather than seeing the future as a seamless

extension of the previous era.

This dynamic--making problems much worse by forcing more of whatever worked in the previous era into a saturated,

increasing unstable new era--receives little attention or understanding.

This dynamic helps us understand why systems that seemed permanent and forever can destabilize and fall apart with

astonishing speed.

We thought we were fixing it by doing more of what worked in the past, but we were actually accelerating the turbulence

and destabilization.

We have a hard time letting go of the idea that the recent past is an accurate guide to the future. In

stable eras, it generally is, but not when an era ends and a new one begins.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, David S. ($200), for your super-outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Marty W. ($120), for your outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |