If conditions change beneath the surface, the folks behind the curtain will be powerless to do anything but make it worse.

This just in: predicting is hard, especially about the future. One solution is ambiguity: couch predictions in poetic allusions that are open to interpretation.

What's hard is making an unambiguous prediction that turn out to be correct. Recency bias often trips us up, as making predictions based on projecting the recent past seems to work well until trends and dynamics change. But due to recency bias, we tend to ignore these signals and focus on whatever supports our belief that the future will be a continuation of the recent past.

If we live long enough to experience several epochal transitions, we start noticing longer-term patterns. One such pattern that attracts little attention is that recessions tend not to replicate the previous recession; they tend to follow the recession before.

So the recession we're now entering won't track the 2008-09 recession, it will likely track either The 1991 recession--shallow and brief--or the previous "real recessions" of 1980-83 or 1973-75.

The recession of 2008-09 was characterized by these dynamics:

1. The price of oil spiked, but fell rapidly back to its previous range.

2. Low inflation generated by the massive deflationary impact of China's expansion of low-cost manufacturing and credit expansion enabled the Federal Reserve to flood the financial system with trillions of dollars, pinning interest rates to zero (ZIRP--zero interest rate policy).

3. Low inflation enabled authorities to "run the economy hot" with cheap, abundant credit that inflated credit-asset bubbles in real estate, stocks and other assets, generating a "wealth effect" in the top 10% who own the majority of the assets.

4. The Fed's balance sheet and federal debt were both modest when measured by GDP, and so these could be expanded with little downside, as these acted as buffers.

The 1991 recession was trigged by a spike in oil prices and risk-off reaction to the first Gulf War (Desert Storm). Once oil prices fell, the impact on interest rates, asset valuations, unemployment, etc. were, by historical standards, mild.

The 1973-75 and 1980-83 recessions were different--stagflationary confluences of embedded inflation generated by price shocks and "running the economy hot." Over time, interest rates (bond yields) tend to track the cost of oil, as the entire economy rests on a foundation of energy.

Adjusted for inflation, oil leaped to a new level in the "oil shock" of 1973-74, triggering a reset of the economy already reeling from higher inflation, foreign competition and sagging productivity.

As the supergiant oil fields discovered in the 1960s started producing at scale in the 1980s, the inflation-adjusted price of oil fell, and remained at historically modest levels interrupted by occasional short-lived spikes (Desert Storm, invasion of Ukraine, etc.).

In the 1970s, energy plateaued at a higher cost level. This--along with other factors--contributed to embedding higher costs, i.e. inflation, that were exacerbated by "running the economy hot," i.e. assuming inflation would magically decline due to "growth."

Instead, inflation became self-reinforcing, threatening to cripple the economy. The only real solution was pushing interest rates high enough to suppress credit expansion, which in an economy dependent on ever-expanding credit, pushed the economy into a deep recession.

Assets fell, valuations stagnated, unemployment soared, credit tightened, and the "easy money" fixes of the past were no longer the solution, they were the problem.

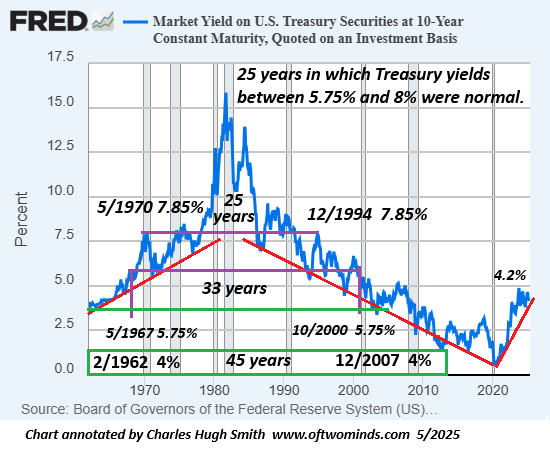

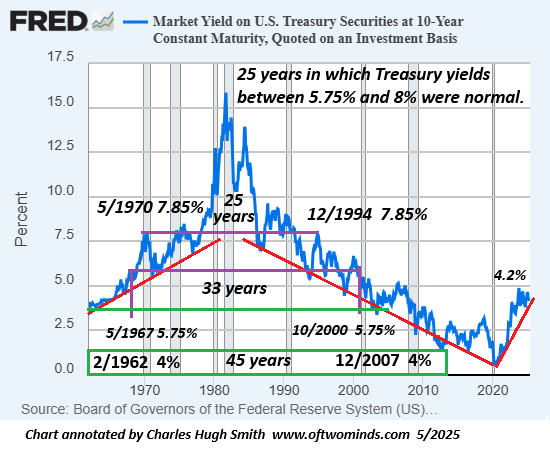

Here we see the yield on 10-year Treasury bonds, a proxy of interest rates:

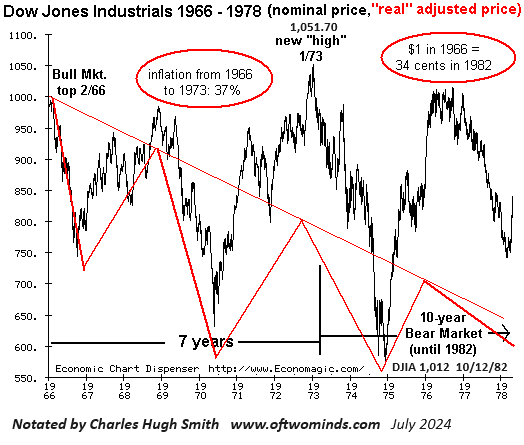

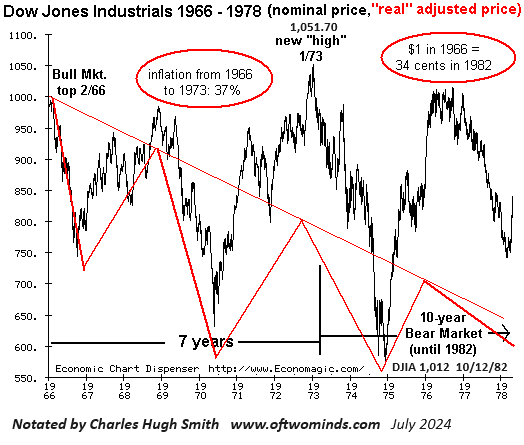

Here is the Dow Jones Industrial Average (DJIA), a proxy of the stock market, adjusted for inflation: by the time the Dow regained the magic 1,000 level in 1982, it had lost 2/3rds of its real (inflation-adjusted) value from its 1966 1,000 peak.

We have succumbed to the illusory belief that "the powers behind the curtain" can--and will--always save us from a market crash and "real recession." What history teaches us is this can only happen in a very specific set of conditions which no longer apply: if oil costs plateau at a higher level, inflation becomes self-reinforcing, credit expansion leads to extremes of risk and productivity remains stagnant, then those behind the curtain will only make the situation worse by lowering interest rates and "running it hot."

At that point, everyone predicting a continuation of the past 18 years will be reaping their reward for being wrong: a margin call in a bidless market. Predicting is hard, but it's good to keep an open mind and avoid recency bias. If conditions change beneath the surface, the folks behind the curtain will be powerless to do anything but make it worse.

My new book Investing In Revolution is available at a 10% discount ($18 for the paperback, $24 for the hardcover and $8.95 for the ebook edition).

Introduction (free)

Check out my updated Books and Films.

Become

a $3/month patron of my work via patreon.com

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Sue K. ($200), for your beyond-outrageously generous subscription

to this site -- I am greatly honored by your steadfast support and readership.

|

|

Thank you, Joel F. ($7/month), for your most generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, Carl M. ($70) for your superbly generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, Craig ($70) for your splendidly generous subscription

to this site -- I am greatly honored by your support and readership.

|

Read more...