This leaves out the purpose of money, which is facilitating social organization.

I've thought a lot about "money" and wrote two books that explore what few understand about money: that it's fundamentally a social construct with a social purpose and structure. The books are Money and Work Unchained and A Radically Beneficial World.

The conventional understanding of money is that it's a financial unit with economic functions--store of value, means of exchange and unit of accounting-- defined by its intrinsic nature as a material that's valuable or convenient.

So gold is "real money" because it's physically permanent, convenient in size and scarce, and fiat currency--paper money and its digital versions--are intrinsically worthless as paper is fragile and digital currency is conjured out of thin air.

This leaves out the purpose of money, which is facilitating social organization. Money's social function and structure is the water we swim in, unseen because we take it for granted.

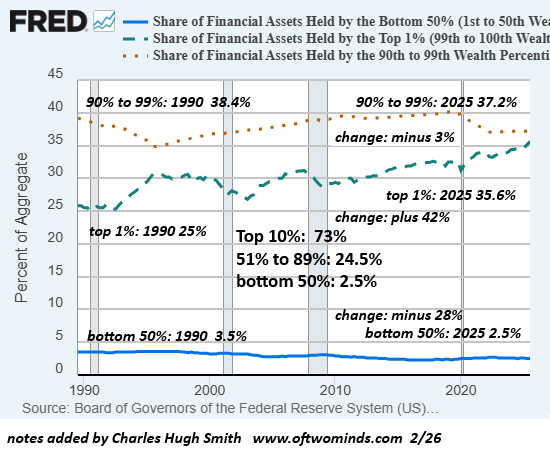

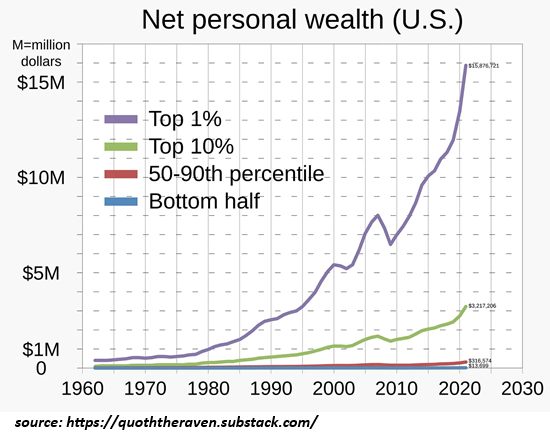

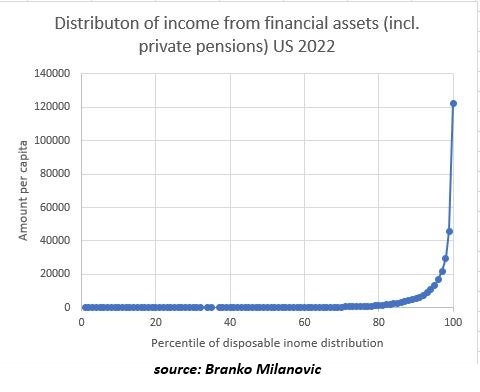

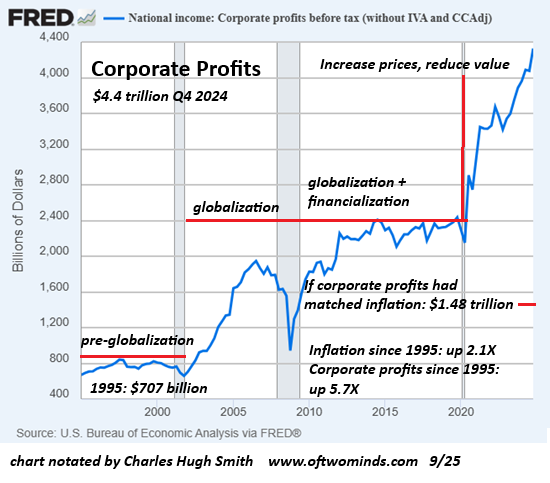

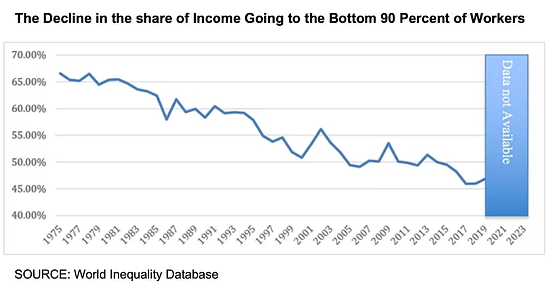

Many have embraced the view that all our problems would be solved if we returned to the gold standard or adopted Bitcoin. The simplicity of this is appealing, but when examined under the lens of social purpose and function, the simple solutions turn out to have limits: being a store of value isn't enough, as the wealthy hoard stores of value and remove them from circulation. Hoarded stores of value don't enable social mobility, they limit it.

When the social waters we swim in become turbulent, money reveals its fluid, adaptive nature. In a severe famine, for example, the most valuable store of value and most sought-after means of exchange are non-perishable food items and train tickets that take the holder far away from the famine. Gold will have potential value on the periphery, but the most valuable "money" are flimsy train tickets and things we can consume to stave off starvation.

Let's shed light on the social nature of money with a thought experiment.

Let's say there is a geographically defined region with scattered gold deposits. that can be panned in streams or collected with simple hand tools. Gold is the store of value and means of exchange, but its exchange value fluctuates depending on the scarcity of what people want to buy: eggs, shelter, tools, etc.

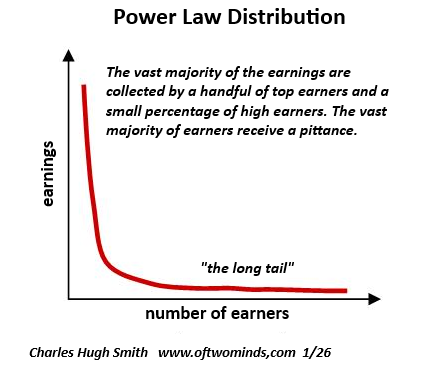

Two townships arise in this region. The first is conventional: mining gold is a "winner takes all" activity: as long as a miner has a legitimate claim, whatever gold is found is theirs to keep. So when a lucky miner stumbles on a big rock that turns out to be almost solid gold, he quietly uses this windfall to buy up the town's mining claims, land and businesses as a silent partner. Once he controls the town, he raises prices to milk the residents, exploiting his gold hoard in an extractive fiefdom.

The fact that gold is money worked well for the wealthy owner hoarding the gold but not for everyone else. Social mobility--a key social purpose of money--is limited in this neofeudal economy.

The other township establishes by vote of the residents a much different social construct for the gold. Rather than "winner takes all," every miner agrees to put 20% of whatever gold they collect into a common fund that has two purposes: to provide a small stake for those miners who have worked diligently but come up empty due to bad luck or illness, and a town "rainy day fund" for periods where the work stops due to severe weather or other events.

Those tasked with collecting and protecting the town's gold fund are duly elected and scrutinized to insure their conduct is above-board and they're doing their job correctly.

This system works well until an extended period of declining yields of gold begins pressuring the service population--the laundries, restaurants, etc. that the town needs to survive. Those managing the gold fund explain the situation and obtain permission from the miners to extend the modest hard-luck stipend to service workers should they otherwise be forced to abandon the town, leaving the residents without key services.

Even when yields stabilize, it's now obvious that the easy gold has been recovered, and yields will continue declining. The town residents face abandoning the town or starting some other industries to compensate for the decline in gold mining.

The leadership comes up with an idea: why not issue paper currency for use in the town, based on the gold still held in reserve, and save whatever new gold is added to the town's fund for trading for essentials from elsewhere? The paper currency will be "backed by gold": as the town's gold won't be spent, this paper money will have something valuable behind it. The paper money is a representation of value rather than a valuable object in itself.

After some skepticism, the miners agree because the other option--abandoning the town--is even less appealing. After all, the decline in gold yields isn't limited to the township; it's happening everywhere. Pulling up stakes and trying to find an as-yet unexploited area is a gamble with poor odds.

After some hesitation, the paper money is distributed to residents as their stipend and used to pay for services and materials. Those accepting the paper find they can buy goods from other merchants with the paper money, and so trust in the new money is established.

Miners who abandoned their claims are paid to dig deeper mines with the paper money, and a small lumber harvesting operation is also funded by the paper money. Merchants still need gold to buy products from afar, but the paper money encourages residents to start producing more food locally. Though gold production is way down, the paper money has funded the labor needed to continue producing enough gold for outside trade.

The town actually expands as new residents take advantage of the opportunities--social mobility is broadening--and while the leaders maintain the town's stash of gold, the paper money that's needed to grease commerce and pay wages now far exceeds the value of the gold in the town vault.

In effect, the town is issuing a fiat currency, a paper money with no intrinsic value, based on the trust that there is gold backing it up.

But this paper money isn't actually valueless. It's backed by the social structure and purpose of the town's economy--the residents' trust in the institutions, their fellow residents, and in the valuable work being enabled by the paper currency.

As long as the worker issued $1 in paper money can buy $1 of goods with that piece of paper, and the merchant who accepts the $1 can buy labor, goods and services with it, the system functions smoothly.

The key to the system's trust is the leadership's discipline in only gradually expanding the issuance of the paper currency in line with the expansion of the workforce and town's economy. For if the currency doesn't expand enough, the town's economy is starved of both means of exchange and "small money" store of value.

If the leaders issue too much paper money, this excess eventually reduces the value of the paper money and residents will lose trust in the system. The ideal they must seek is scarcity of paper money, but not so severe that it begins limiting hiring and commerce. They must resist the natural demands for more money entering circulation, as the entire structure is trustworthy precisely because there is resistance to issuing any more than the absolute minimum needed to keep the wheels of commerce turning.

But consider what happened: a gold standard--gold was the only money--was dooming the township as the supply of new gold was no longer enough to turn the wheels of commerce. The social purpose of money--maintaining a viable economy, social mobility and a vibrant social order--demanded the introduction of fiat currency, which could be prudently expanded as needed.

The town thrived by doing what many consider is the opposite of financial wisdom: they abandoned a gold standard in favor of fiat currency as the only means of not just surviving, but of thriving by enabling an expansion of work and initiative.

(if this seems farfetched, study the history of paper money in dynastic China.)

This is why I have suggested a labor-backed currency: rather than return to a system in which the wealthy hoard the majority of gold or Bitcoin, or give the power to issue currency to central banks and private banks who enrich those already at the top of the wealth-power pyramid, money is only issued when useful work has been performed. This money is created at the bottom of the pyramid to pay those doing useful work, which is the ultimate foundation of a productive social order and economy.

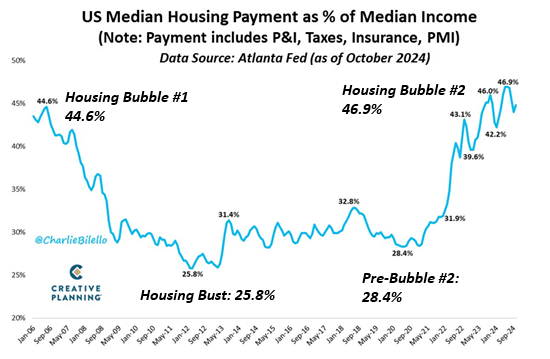

Money is a social construct with an implicit structure and purpose which we swim in but don't even see. Money is fluid and must adapt to fulfill social purposes. If it fails to do so, it's not just money that fails, the entire society fails.

My new book Investing In Revolution is available at a 10% discount ($18 for the paperback, $24 for the hardcover and $8.95 for the ebook edition).

Introduction (free)

Check out my updated Books and Films.

Become

a $3/month patron of my work via patreon.com

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Mark E. ($70), for your massively generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, Tomas ($7/month), for your magnificently generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, A Water Bearer ($7/month) for your superbly generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, Ryan P. ($7/month) for your splendidly generous subscription

to this site -- I am greatly honored by your support and readership.

|

Read more...