The world's worst negotiating strategy is to make a crazy tulip-bubble stock market rally dependent on a trade deal that harms the interests of the U.S.

The world's worst negotiating tactics, the equivalent of handing the other side a loaded gun while waving a squirt gun around, are:

1. Declare a de facto political deadline for a deal. Constantly tweet that a deal is imminent. This gives the other side unparalleled leverage: having backed yourself into a deadline corner, where any delay will be viewed as a political defeat, the other side knows it doesn't have to concede anything to get a deal out of you. You'll cave in to every one of their demands due to the fatal stupidity of creating an arbitrary deadline.

2. Hinge the entire advance in U.S. stock markets on a trade deal being signed.President Trump and the corporate media have goosed U.S. stock markets higher for three long months with rumors of an impending trade deal with China.

This reliance on a trade deal to goose stocks ever higher gives the other side enormous leverage, as they can now say: give us everything we want or we walk, and your stock market crashes.

Making matters even worse, the entire U.S. status quo has made the stock market the one signifier of the economy: if the trade deal evaporates and the market crashes, that calls into question the entire (bogus) narrative of endless growth.

Thus it is easy to predict that 1) there will be no U.S.-China Trade Deal signed in the next few weeks or months (i.e. U.S. negotiators realize no deal is better than a bad deal) or 2) any Trade Deal that's signed will be either worthless (i.e. a meaningless PR gesture) or worse, actively harmful to U.S. interests because it gave the Chinese everything and got nothing for the U.S. except a bunch of empty unenforceable promises.

No wonder the Chinese leadership is extremely confident they can pressure President Trump and his team into a phony "deal" that leaves all of China's advantages intact and gives the U.S. nothing.

As noted above, they know President Trump has constantly been touting U.S. stock market gains, and that these gains are largely based on the promise of a "trade deal" being signed soon. Every tweet that President Trump has issued promising a deal in the next few days has strengthened the leverage of China's negotiators, as it's obvious to all that it's impossible for the U.S. to back out of the deal without crushing the U.S. stock rally.

The Chinese leadership is also extremely confident that they can "play" President Trump's impatience to "close a deal" even if it is disastrous to U.S. interests. Once again, all the psychological leverage is in the Chinese team's hands while the U.S. has been backed into an absurd corner by the constant touting of a trade deal to boost stocks to insane levels of over-valuation.

The Chinese leadership is also confident that their economy has weathered the worst of the slowdown and is now on the mend, and so they no longer need a trade deal with the U.S. (It's difficult to imagine the Chinese leadership believing their own bogus public statistics, but perhaps they have confidential data that supports their claim.)

The only way the U.S. can re-establish any measure of leverage is to walk away from the empty-gesture agreement China is pushing. In other words, the only way to get a deal that's in the interests of the U.S. is to call China's bluff, break off negotiations, take the hit to the bloated U.S. stock market and then see whose economy is in better shape six months from now.

If the U.S. economy is in better shape than China's in six months, then China will have incentives to sign an agreement that meets the minimum interests of the U.S.

If China's economy is in better shape than America's in six months, then the U.S. can sign the same worthless agreement that it rejected in April: no harm, no foul.

Who is more dependent on the other? Commentators have argued for a decade that China's purchase of U.S. Treasury bonds gives it immense leverage. Given that the Federal Reserve can create $1 trillion in a few seconds and buy China's entire Treasury holdings, this is zero leverage.

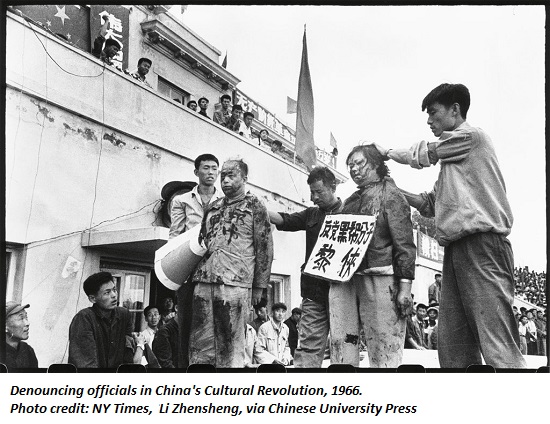

Export-dependent manufacturing nations need customers for their excess production. No customers, no sales; no sales, no jobs; no jobs, hello Cultural Revolution #2, never mind the millions of security cameras being installed to impose a Chinese Big Brother Police State.

The world's worst negotiating strategy is to make a crazy tulip-bubble stock market rally dependent on a trade deal that harms the interests of the U.S. Yet that's just what the U.S. has done, over-promising on a daily basis to goose an overvalued stock market a few points higher.

The only way to protect the interests of the U.S. is to walk away from the negotiations and renounce the deal. Anything less is an empty PR gesture that harms the interests of the American economy and people.

The only way to avoid a bad deal is to walk away and await a better opportunity down the road.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Mark H ($50), for your splendidly generous contribution to this site -- I am greatly honored by your steadfast support and readership.

| |

Thank you, Gerald B. ($50), for your superbly generous contribution to this site -- I am greatly honored by your support and readership.

|