The Coming Crisis of Cities: Reinvention or Bankruptcy

Those who got out early (i.e. now) will be glad they acted promptly and those caught in the decline will regret their faith in a high-cost system that was no longer affordable or sustainable.

Our confidence that cities are forever is misplaced. History informs us that cities arise and decline just like civilizations: cities decline when the material essentials needed to support their vast populations are no longer affordable or available in sufficient quantities, or when the economic benefits produced by the city no longer outweigh its immense costs.

Let's start by reviewing why cities have been features of human life for thousands of years.

The human population has become increasingly urbanized for compelling reasons that have been in play since cities were founded thousands of years ago.

In a nutshell, cities offer greater economic / social opportunities and more novelty, variety and excitement.

Cities became possible when agricultural surpluses enabled labor to become specialized. This increased:

1. productivity, as skilled workers in workshops, mills, kilns, etc. could produce more goods per unit of time than households;

2. transportation, enabling the expansion of trade of commodities from rural areas and manufactured goods from other cities;

3. commerce, as goods could be warehoused in secure entrepots and sold in markets that attracted buyers from the entire region;

4. governmental services, as taxes on all this activity funded infrastructure and state and military functions;

5. non-governmental functions such as temples, schools, the arts and entertainment.

On the downside, cities were crowded and unsanitary and thus killing zones. Cities relied on mass in-migration of new residents to offset the horrendous annual death toll from cholera, plague and other infectious diseases.

Other hazards included conflagrations, being sacked by rapacious armies and rampant crime, especially at night (there were no streetlights in ancient Rome).

Elites congregated in cities because power was wielded in person. The ambitious of all classes also gathered in cities, as this was where wealth and power offered opportunities to get ahead.

As Fernand Braudel observed in his histories of France and European Capitalism, cities have always had higher costs of living due to this ever-greater demand for commodities, services, shelter and land.

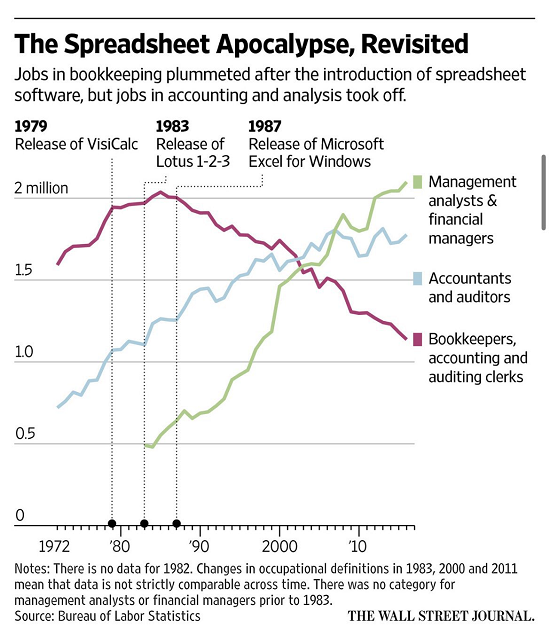

The core utility and function of cities changed as the economy industrialized. The First Industrial Revolution of the 19th century required vast aggregations of capital, which led to the rise of banking and finance: surplus labor and workshops were no longer enough, finance had to scale up to fund the immense investments required to build real-world infrastructure such as railways, ports, mines, factories, etc.

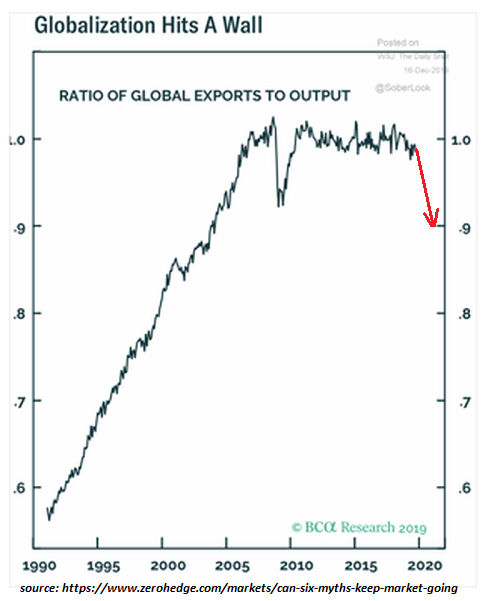

The expansion of globalization as nation-states expanded into empires also placed a premium on finance and its sibling, insurance, as the financial risks of large-scale capital had to be hedged. This expansion of complexity required a managerial class trained in an expanded system of education, and a government capable of regulating this expanding systemic complexity.

Cities did not cease being centers of manufacturing and commerce; the so-called FIRE economic functions (finance, insurance, real estate) were added to the city's core functions.

This mix began changing as advanced nations shifted to post-industrial "knowledge" economies. Dirty industries were shipped overseas or relocated outside urban areas, container ports replaced labor-intensive ports, and cities hosted the expansion of the "knowledge" industries of marketing, digital technologies, communications, data processing, etc.

Cities such as San Francisco transitioned from working-class economies of longshoremen, factory workers and shop-keepers to "knowledge/FIRE/tourism" economies, as the legacies of the working class city--the cable cars, port warehouses, Chinatown, North Beach (the Italian immigrant neighborhood)--became, in Jerry Mander's phrase, "replicas of themselves," urban Disneyland-type attractions.

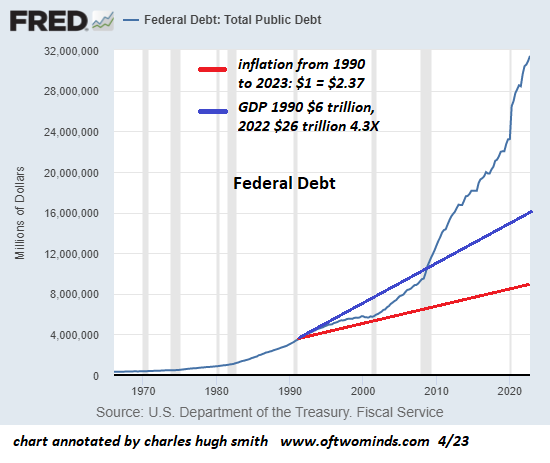

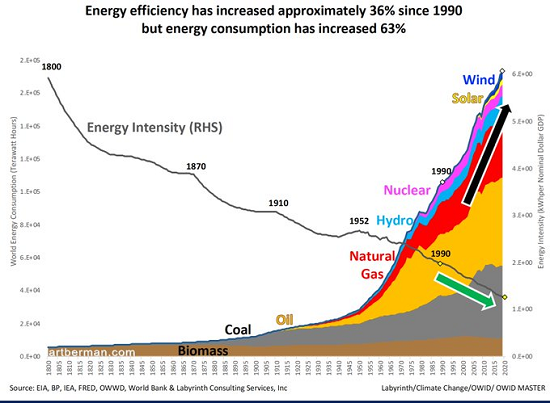

The runaway expansion of financialization and globalization that has fueled the explosive expansion of the global economy for the past 30 years was kind to "knowledge/FIRE/tourism" cities and unkind to commodity-producing rural areas, as a flood of global supply suppressed the value of commodities. Small towns that lacked the high-paying jobs of the knowledge/FIRE economy decayed as capital and talent migrated to mega-cities.

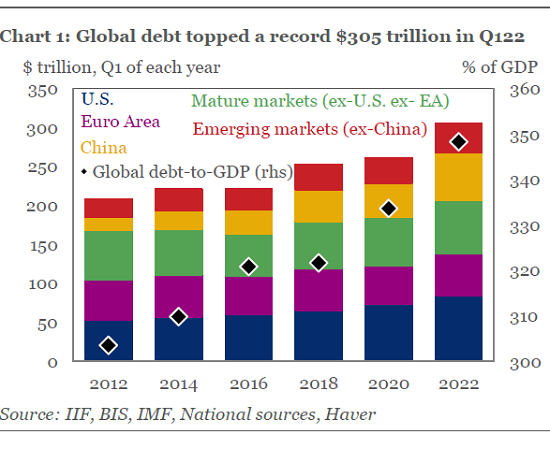

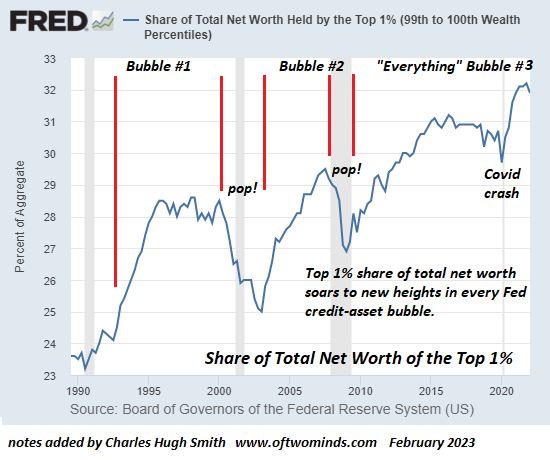

As I've often explained, financialization and globalization generate systemic inequality by their very nature. Financialization makes the rich even richer and the poor even poorer. This fact is visible in the many Federal Reserve charts I've published over the past 15 years. (see chart below)

Globalization has pursued the neoliberal dream of eliminating barriers to the free flow of global capital, and so the top 5% globally whose wealth exploded in globalization have the means to buy up real estate in prime "globalized" cities such as New York and San Francisco.

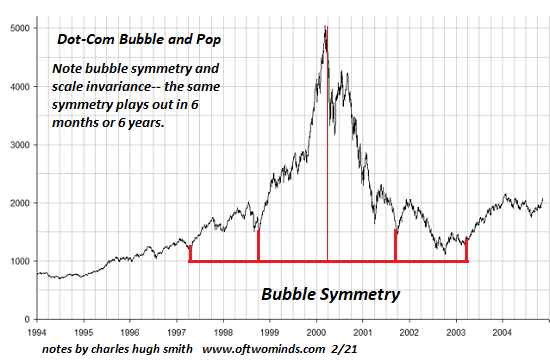

By artificially suppressing interest rates and flooding the system with credit available to the wealthy, the Federal Reserve has inflated one enormous speculative bubble after another in the past 25 years. The net result is cities are no longer affordable to the bottom 80%, or even the bottom 90%.

Here is a real-world example. Friends of ours in the San Francisco Bay Area, a husband and wife who both worked part-time at average-paying municipal jobs, bought a small, old house in a desirable suburb for $145,000 in the late 1990s. Other friends bought slightly larger homes for $165,000 in this Dot-Com Bubble era.

Adjusted for inflation, these homes would now cost between $270,000 and $300,000. Given the conventional 4-times-income requirement for mortgages, homes in this price range would still be affordable to households earning $75,000 a year. This isn't much higher than the median wage of full-time workers in the US (currently $56,000 annually). A household with one full-time worker and a part-time worker could still manage to own a home.

But these houses are now worth in excess of $1 million. Only the top 10% of wage-earning households can afford to buy a home in the SF Bay Area.

The rent for a modest house in this area is $4,500 to $5,000 a month. Households earning $100,000 annually take home about $75,000, and so they can barely scrape by, as 2/3 of their income is spent on shelter (rent and utilities). There is no way they can afford either children or home ownership.

This was not the case 25 years ago. This is the bitter fruit of financialization and globalization.

Those who bought houses 20 or more years ago are now wealthy, through no effort of their own. This generational inequality is tearing apart the social fabric. This level of inequality can have no other result.

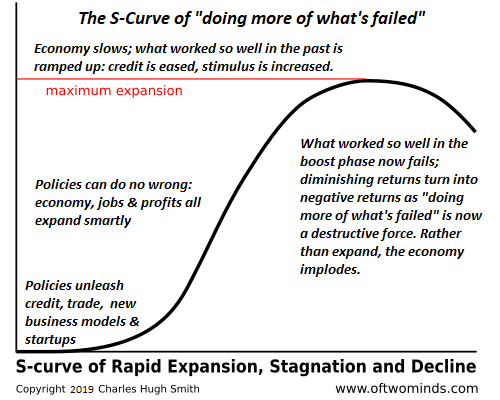

Now cities are facing another transition, one that threatens their high-cost dominance: remote work and the reversal of financialization and globalization. Interest rates and inflation are rising for systemic, cyclical reasons, and globalization is reversing as national security becomes more pressing than increasing corporate profits.

Correspondent Tom D. summarized the systemic crisis of cities in five poetically terse points:

"The city has lost its utility.

It was a center of manufacturing--that went away.

Then it was financialization--that's going away.

All that's left are legacy costs.

A great untold story. The impact will be huge."

In summary, here's what's happening: given the increasing speed of digital communications, the majority of the knowledge/FIRE economy work can be done from anywhere. This has long been the reality, but the pandemic lockdown accelerated the recognition of this reality.

Given the higher wages paid to knowledge workers and the absurdly high costs and life-limitations (kids and homeownership are unaffordable) of living in big cities, the incentives for those who were too young to buy a house for $150,000 that's now worth $1 million are to move to an affordable locale and abandon the marginal benefits of the city (novelty, entertainment).

The incentives for the poor living on social-welfare benefits and the working-poor who do "real-world" jobs is to stay put, as their opportunities are considerably diminished in less wealthy regions.

The problem is the poor and working-poor pay a relatively modest percentage of taxes. The high-wage earners who are incentivized to leave pay the majority of taxes.

Cities are terribly costly to operate, and most of these costs are fixed, meaning they stay the same regardless of how many customers use the services. About 75% to 80% of all municipal budgets (the general funds, not projects paid by borrowing money via selling muncipal bonds) go to labor--government employees and their pension/healthcare costs.

Buses, subways and trains all have the same fixed costs and staffing whether they're full or empty.

The BART subway/train system in the SF Bay Area is an example of how high fixed costs and declining ridership creates a "doom loop"--a "doom loop" that hollows out downtown office towers and the small businesses that depend on thousands of commuting office workers, and the transit systems that bring the workers to the office towers.

BART ridership has fallen precipitously, from 400,000 riders a day pre-lockdown to 166,000 today. This 60% decline in rider-paid revenue is far below the system's fixed costs, and so somebody somewhere has to be taxed more to subsidize the system.

The older generations who've become wealthy due to the soaring value of their homes naturally want everything to stay the same: they want their homes to continue being worth $1 million, their property taxes to stay the same, the city services to stay the same, and so on. Speculative bubbles, financialization and globalization have been very good to them and they are unwlling to face the doom-loop generated by the excesses of financialization and globalization finally coming home to roost.

A Tale of Paradise, Parking Lots and My Mother's Berkeley Backyard. (NYT.com)

But this isn't realistic as young remote workers (and those older workers who want to cash out their massive gains and retire in more affordable locales) leave, the legacy costs remain sky-high but there are fewer residents with the wealth and income to pay for them.

Somebody has to pay more, or these services will go away. Municipal workers are unionized and will resist reductions in pay and benefits, even in municipal bankruptcy.

Remote work and the systemic inequality created by financialization and globalization are generating a doom-loop of incentives to leave before the inevitable collision with reality occurs: either services are slashed or taxes are raised, or more likely, both.

Higher taxes and fees means there is less income left to spend on novelty and entertainment. So raising taxes to pay legacy costs diminishes the disposable income needed to support the entertainment, dining, arts, etc. industries.

There are macro-consequences of the cyclical end of low inflation and low interest rates that also feed into the urban doom-loop. As the costs of essentials continue climbing, the bottom 90% have less disposable income to spend on vacations, novelty and entertainment. This means cities depending on the free-spending pursuit of pleasure will only be affordable to the top 10% who have bubble-generated wealth or unearned income from wealth.

The end of cheap commodities and money is a global transition which will reduce the disposable income of the majority of people who are currently free-spending tourists. Tourism, the most vulnerable form of disposable spending, will decline globally, possibly precipitously in high-cost cities.

Yet this "the pleasures of the city" model is what's being offered as the "fix" for the doom-loop:

26 Empire State Buildings Could Fit Into New York's Empty Office Space. That's a Sign.

"New York is undergoing a metamorphosis from a city dedicated to productivity to one built around pleasure."

The problem is only the top 10% can afford the city's pleasures, and that's simply not enough to fund the immense legacy costs. Furthermore, the top 10% have the means to spend now, but once the unsustainable bubbles pop and borrowing money becomes unaffordable, even the top 10% will be hard-pressed.

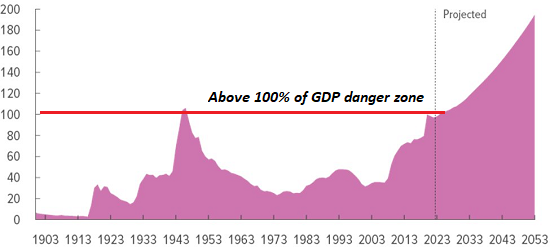

Super-low interest rates have enabled cities and counties to spend freely on infrastructure by selling municipal bonds. Now that interest rates are rising (and regardless of what many claim, they won't be going back to near-zero). This puts strict limits on how much more cities can borrow without degrading their credit-rating to "junk." So the gravy-train of cheap-to-borrow money has ended. Now it will require belt-tightening snd higher taxes to keep cities operating at their current levels.

All of this changes the incentives and cost-benefit assessments everyone uses to make life decisions.

The book

The Upside of Down explained that average people will support a system in which the benefits outweigh their costs, but abandon it when the benefits decline far below their costs. The costs of city-living will increasingly exceed the benefits.

These structural shifts in the core utility of cities are already apparent. Shopping in bustling, exciting districts is fun, but everyone can get virtually anything they want delivered to their door now. The bustle is fading, and so is the fun. As for entertainment, big acts like Taylor Swift still motivate people to spend thousands of dollars, but as a general rule, we have inexhaustible entertainment (or at least distraction) on our phones, laptops, TVs, etc.

These lower-cost forms of entertainment offer stiff competition for the shrinking pool of discretionary income available for tourism and entertainment.

There's another pressure on the top 10%: they're the only group who can afford to pay more taxes. So they will have to pay all the new taxes needed to pay the city's fixed / legacy costs. And these tax increases will have to be substantial. Simply funding the employees' pension plans will push city budgets deep into the red.

There is a self-reinforcing feedback loop in raising taxes: at some threshold, high-earner households will conclude the benefits no longer outweigh the costs and they'll sell out and leave.

Cities are projecting a never-ending era of free-spending tourists and soaring capital gains taxes generated by stock markets and real estate. But these are all precisely what evaporates in a recession as costs of essentials and borrowing money rise.

Assuming the glorious free-borrowing-spending of the past 30 years will continue forever is unrealistic to the point of madness. But any more realistic projection is unacceptable, as it inevitably reveals municipal bankruptcy as the end-game.

As for the consequences of remote work, they are already visible in statistics. The Bureau of Labor Statistics (BLS) recently released employment and wage data nationally and in the most populous 350 counties in the US. On the national level, employment rose about 2% and wages fell about 2%.

County Employment and Wages Summary (BLS)

But in the high-wage, high-cost Silicon Valley counties, the decline in wages is staggering:

San Francisco: -22.6%

San Mateo: -20.7%

Santa Clara: -15.0%

High-cost states suffered significant wage declines:

California: -6.9%

New York: -5.1%

Some of these declines may be the result of tech-sector layoffs, but the number of jobs in all these regions increased by over 2% from Dec. 2021 to Dec. 2022. The more likely primary cause may be companies paying lower wages when employees switch to remote work.

15% to 20% declines in wages paid are absolutely monumental. They add up to billions of dollars that are no longer available to pay taxes or fund city-centric "pleasures."

These statistics raise big questions about the viability of housing prices staying so high that only the top 10% can afford to buy homes. How many in-migrants will earn top-10% salaries? How many out-migrants are taking their earnings somewhere where they can hope to afford a family and a house?

Who's going to be left who is willing and able to pay much higher taxes and fees to pay the sky-high legacy costs built up during the glorious 30 years of urban expansion fueled by speculative bubbles?

Depending on a free-spending top 10% seeking city-specific pleasures seems like a strategy that will accelerate the doom-loops now in play. A better strategy would be to reinvent the city to once again be affordable to the working poor and the middle class. But that transition will have to wipe out all the bubble-generated "wealth" of the past 25 years and shrink legacy costs to what the diminished workforce can afford.

Those accustomed to the glory days of ever-expanding unearned wealth will resist this transformation until it's too late to manage a graceful transition. The bubbles will collapse and bankruptcy will clear the excesses. Those who got out early (i.e. now) will be glad they acted promptly and those caught in the downdraft / decline will regret their faith in a high-cost system that was no longer affordable or sustainable.

Reducing our exposure to avoidable risks is a key strategy of

Self-Reliance.

This essay was drawn from my Weekly Musings Reports sent exclusively to subscribers, patrons and Substack subscribers. Thank you very much for supporting my work.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, foreverfarm ($5/month), for your marvelously generous Substack subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Mike M. ($54), for your splendidly generous contribution to this site -- I am greatly honored by your support and readership. |

|

Thank you, Matt V. ($5/month), for your superbly generous Substack contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, David D. (nice shirt), for your outstandingly generous gift to this site -- I am greatly honored by your steadfast support and readership. |