In refusing to recognize that inequality had the potential to bring down the entire system, our delay has made that reckoning inevitable.

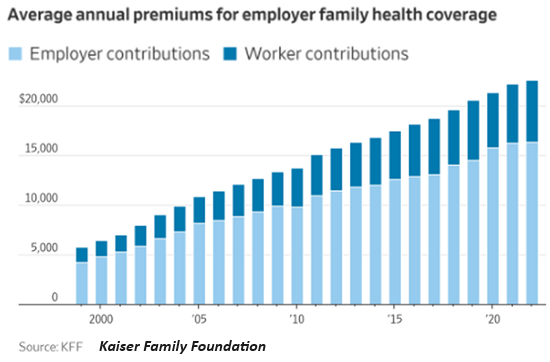

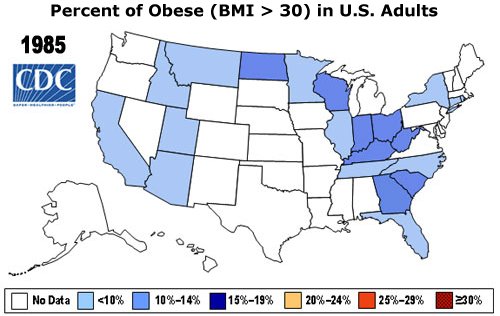

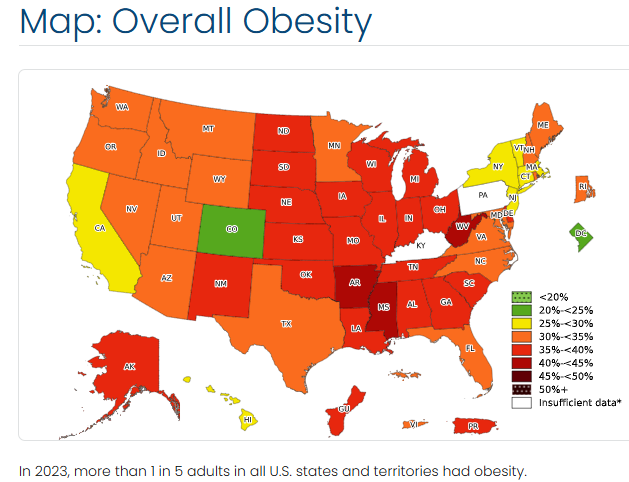

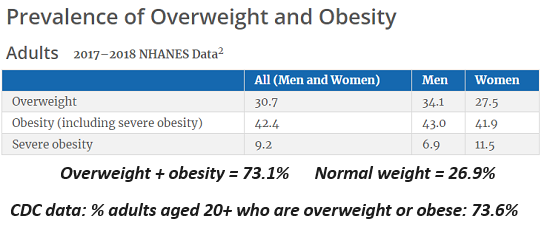

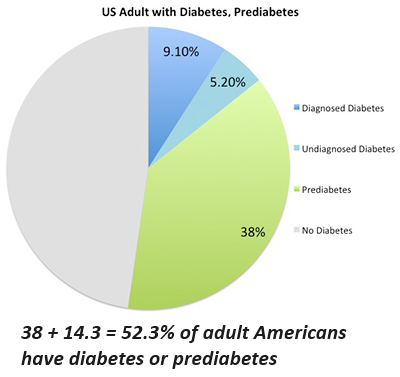

The theme here is problems are not resolved, they're papered over with profitable faux fixes. In my previous post, I described how the problem of our collective health crisis isn't being resolved, it's being milked for profit by faux "solutions" that don't actually resolve the problem, they keep it on simmer because this is the most profitable arrangement for those providing the illusory "solution."

I have endeavored to explain why extreme inequality will undo not just democracy, it will undo the entire social order and the economy as well. We currently live in a fantasy world in which finance and market forces operate with impunity, as the focus is on profits and "growth."

That finance and market forces have profound social consequences is ignored. This reality has been explored since the 1800s, by critics ranging from Emerson to Marx ("All that is solid melts into air, all that is holy is profaned") to modern critics such as Christopher Lasch, author of The Revolt of the Elites and the Betrayal of Democracy (1995) and more recently, by Jeffrey L. Degner in his new book Inflation and the Family: Monetary Policy's Impact on Household Life, which is described in

The Social Costs Of Inflation (Quoth the Raven, via Rich W.)

That inequality of wealth, income and opportunity has reached dangerous extremes in America has been starkly visible since the save-the-fraudsters response to the 2008-09 Financial Fraud Meltdown (a.k.a. the Global Financial Crisis). In the aftermath, a number of incisive essays were published by journals left, right and center on the urgent need to address soaring inequality.

These three essays from 2011-2013 cover the many systemic dynamics of this problem: I cannot stress strongly enough that neither the left nor the right have mounted a meaningful response, as this is not an issue that boils down to a strictly partisan / political or economic problem--it encompasses the entirety of the status quo system: culture, society, economy and the political/policy sphere.

This not-left-or-right nature confuses many, who automatically seek to compartmentalize the problem and proposed solutions as left or right. Inequality cannot be constrained to stale political boundaries if we are to understand it as a problem that needs real resolutions, not superficial fake fixes. This is perhaps best exemplified by Christopher Lasch, whose nuanced work cannot be pigeonholed as right or left.

His savaging of the status quo economy's dismantling of the family can be interpreted as conservative, while Lasch's appreciation of Marx's critique can be labeled progressive. Both labels are misleading, as Lasch's work cannot be understood within the narrow confines of conventional knee-jerk us-them thinking.

This applies to all thoughtful discussions of soaring inequality. Mike Lofgren's essay in the August 2012 issue of The American Conservative magazine is a brilliant summary of just how far we've fallen:

Revolt of the Rich: Our financial elites are the new secessionists:

"It was 1993, during congressional debate over the North American Free Trade Agreement. I was having lunch with a staffer for one of the rare Republican congressmen who opposed the policy of so-called free trade. To this day, I remember something my colleague said: 'The rich elites of this country have far more in common with their counterparts in London, Paris, and Tokyo than with their fellow American citizens'."

"Lasch held that the elites--by which he meant not just the super-wealthy but also their managerial coat holders and professional apologists--were undermining the country's promise as a constitutional republic with their prehensile greed, their asocial cultural values, and their absence of civic responsibility.

Lasch wrote that in 1995. Now, almost two decades later, the super-rich have achieved escape velocity from the gravitational pull of the very society they rule over. They have seceded from America."

Jerry Z. Muller, Professor of History at the Catholic University of America, wrote a dispassionate, thorough essay on the many structural sources of inequality in 2013:

Capitalism and Inequality: What the Right and the Left Get Wrong (April 2013)

(In 2012): "The central focus of the left today is on increasing government taxing and spending, primarily to reverse the growing stratification of society, whereas the central focus of the right is on decreasing taxing and spending, primarily to ensure economic dynamism. Each side minimizes the concerns of the other, and each seems to believe that its desired policies are sufficient to ensure prosperity and social stability. Both are wrong.

Inequality is indeed increasing almost everywhere in the postindustrial capitalist world. But despite what many on the left think, this is not the result of politics, nor is politics likely to reverse it, for the problem is more deeply rooted and intractable than generally recognized. Inequality is an inevitable product of capitalist activity, and expanding equality of opportunity only increases it--because some individuals and communities are simply better able than others to exploit the opportunities for development and advancement that capitalism affords.

Despite what many on the right think, however, this is a problem for everybody, not just those who are doing poorly or those who are ideologically committed to egalitarianism--because if left unaddressed, rising inequality and economic insecurity can erode social order and generate a populist backlash against the capitalist system at large."

George Packer unpacked the sources of decay that push inequality to extremes in his comprehensive December 2011 essay

The Broken Contract: Inequality and American Decline:

"Inequality hardens society into a class system, imprisoning people in the circumstances of their birth--a rebuke to the very idea of The American Dream."

(in 2012:) "The same ailments were on full display in Washington this past summer, during the debt-ceiling debacle: ideological rigidity bordering on fanaticism, an indifference to facts, an inability to think beyond the short term, the dissolution of national interest into partisan advantage."

Muller and Packer dismantle every conventional "solution" as inadequate or worse: more education, more policy tweaks, financial gimmicks--all are fake fixes that avoid the hard part, which is addressing the underlying decay in both our society and economy that has replaced "solutions" with self-enrichment.

I elaborate the way this replacement of real solutions with self-enrichment has been systematically normalized in my new book Investing In Revolution.

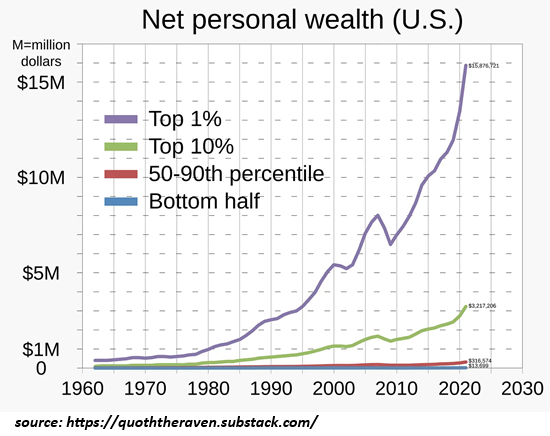

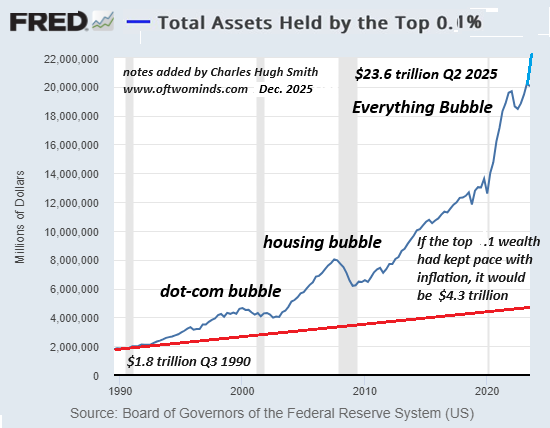

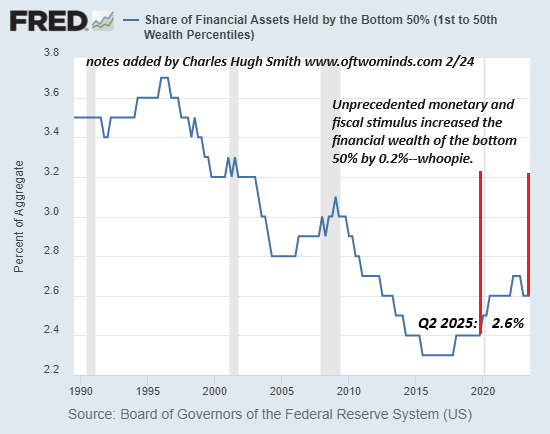

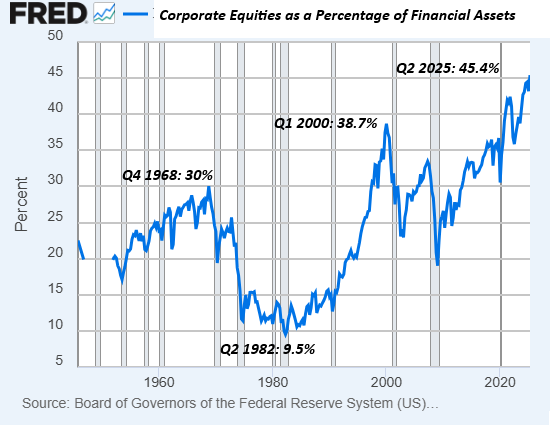

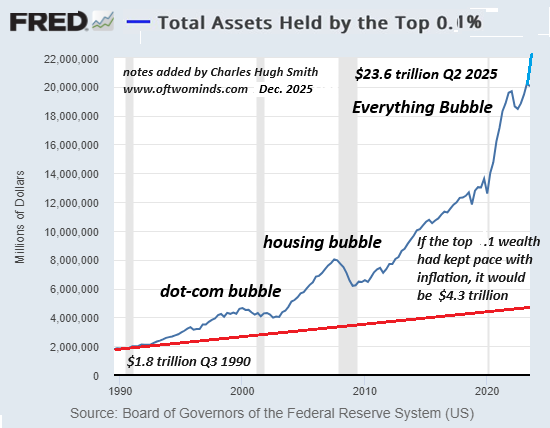

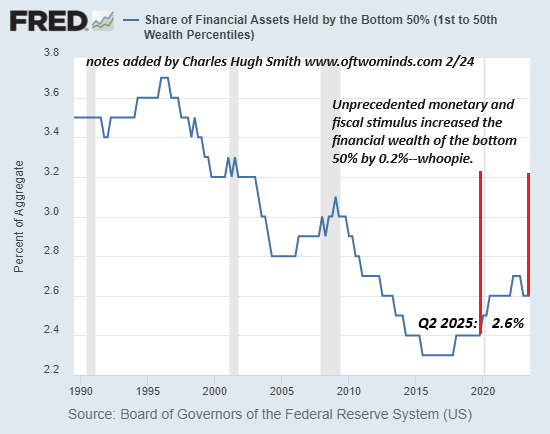

I often reprint this chart from the Federal Reserve because it shows how the wealth (and thus the power) of the wealthiest has achieved escape velocity not just from inflation but from any restraints.

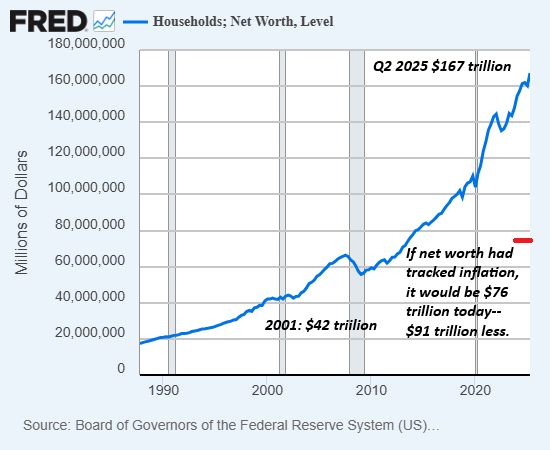

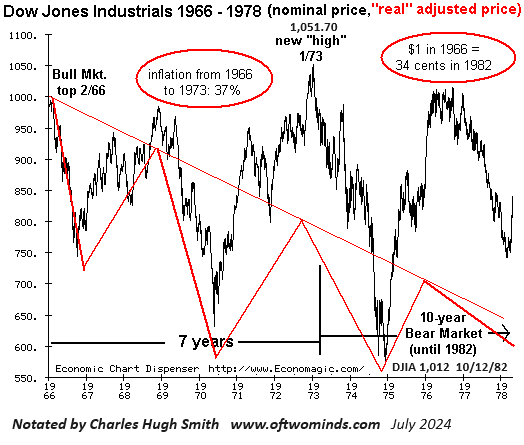

And I often reprint this chart to show how the bottom 50% of Americans have actually lost ground in the "wealth creation" of asset bubbles.

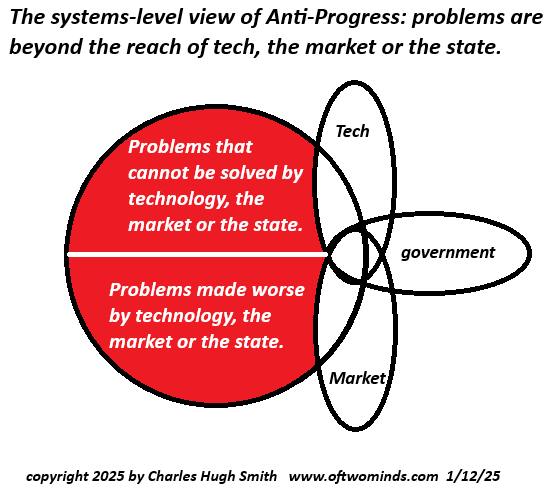

The fantasy-fake solutions of both the left and right distill down to financial-technocrat fixes that leave the engines of inequality untouched, as those proposing the faux fixes don't dare upset the gravy train that's enriching everyone in the top tier of the status quo.

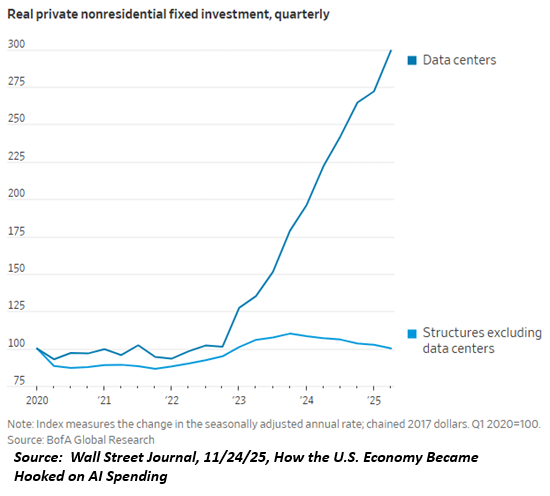

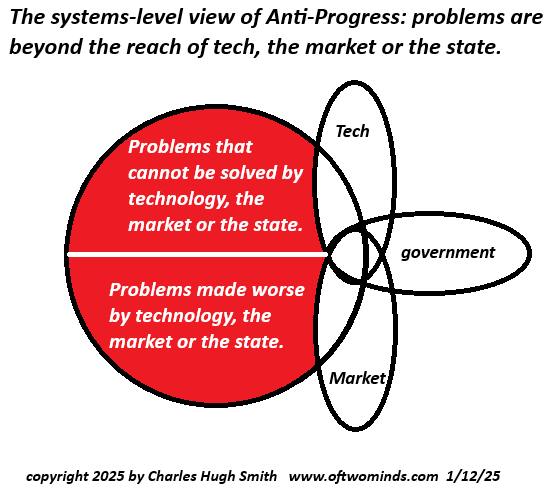

I composed this chart to illustrate how the usual bag of fake fixes--more tech, technocratic, political policy tweaks, so-called market-solutions--all avoid uprooting the system that increases inequality by its very nature because this system benefits the few at the top at the expense of the many--and the few control the machinery and manage the gearing.

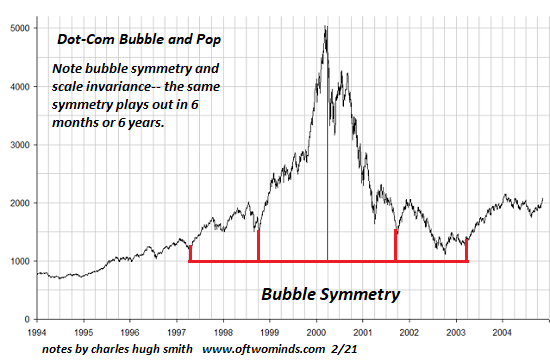

If we'd tackled inequality in 2012-13 with resolve, regardless of the pain that would cause those currently enriching themselves with impunity, we might have gotten somewhere by now. But we didn't. And now it's too late.

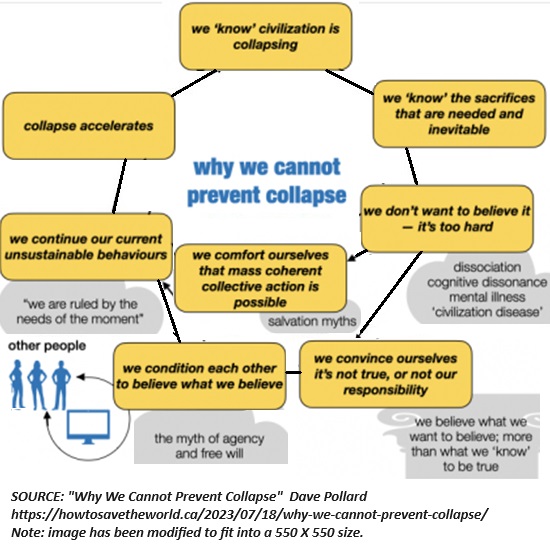

Doing nothing is an illusory "solution." Systemic problems like inequality are not unchanging items that await our attention; they are dynamic and self-reinforcing, and in refusing to recognize that inequality had the potential to bring down the entire system, our delay has made that reckoning inevitable.

My new book Investing In Revolution is available at a 10% discount ($18 for the paperback, $24 for the hardcover and $8.95 for the ebook edition) through November.

Introduction (free)

Check out my updated Books and Films.

Become

a $3/month patron of my work via patreon.com

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Dennis P. ($70), for your magnificently generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, David E. ($7/month), for your marvelously generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, D.G. ($7/month), for your superbly generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, Francis ($7/month), for your splendidly generous subscription

to this site -- I am greatly honored by your support and readership.

|

Read more...