How to Identify a Bubble: Wall Street Says It's Not a Bubble

The post-bubble-crash phase is already being prepared:

'no one could have seen this coming'--except anyone who paid attention to anything other

than self-interested shills.

It's really pretty simple to identify a speculative bubble of epic proportions in stocks:

if Wall Street says it's not a bubble, it's a bubble. As I explained in

The Smart Money Has Already Sold, from the long view the entire game of "investing" (wink-wink)

boils down to one dynamic:

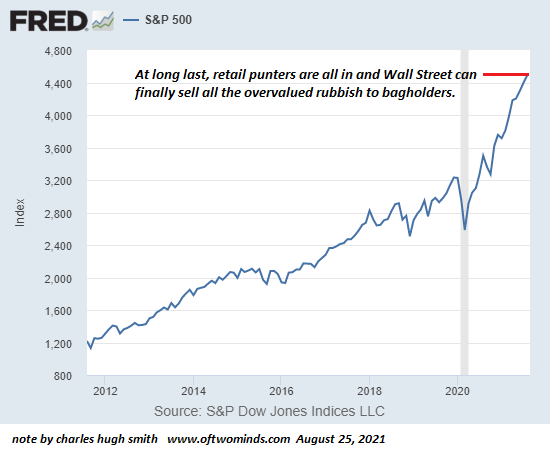

Wall Street and the Federal Reserve inflate an unprecedented debt-funded speculative bubble

and then lure retail "investors" (i.e. gamblers) in with the promise that the enormous gains

are just starting, there's so much more easy money ahead, etc. Then Wall Street distributes

(sells over time so as not to alert the complacent herd of retail punters) its shares of overpriced

rubbish ("investments", heh) to bagholders, and then to everyone's surprise (or not), the market

suddenly crashes as the unsustainable bubble pops.

Wall Street has long practice in how to reassure the herd: since insiders have juiced the

market higher for years at every dip (with the Fed's free trillions offering a helping hand),

the bagholders have been well-trained to buy the dip even as the wheels come off the

whole "this time it's different" scam.

Human psychology being what it is, desperate retail bagholders cling to the delusional belief

that a recovery to new highs is just around the corner, because that's what the market has done

for 13 straight years.

Every decade or so--1999-2000, 2007-2008, and now 2020-2021--Wall Street's roving army of

shills spews the same paper-thin justifications for "this is not a bubble":

this rally is just getting started, we're assured because 1) corporate profits are rising and

will support much higher valuations; 2) the Federal Reserve will never let any bubble pop

(said in so many words) and 3) if we look at comparative charts of quatloos, the British pound

in the 1820s, the current price of sake on the Sendai Exchange and bat guano futures, it's

obvious the S&P 500 is still undervalued. (Use as many arcane charts as possible to wow the

bagholders.)

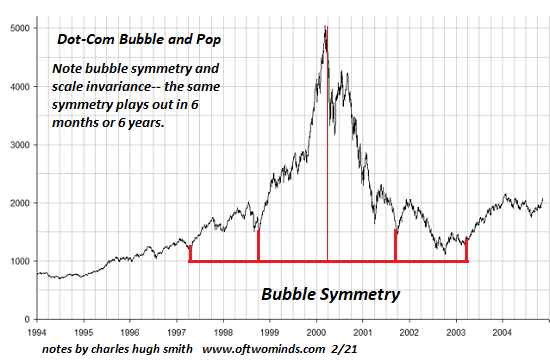

Sadly, it's all so easy. The hardest part is waiting for the pain from the last bubble popping

to diminish enough for greed to overwhelm caution. Wall Street only had to wait five years

from the nadir of the dot-com bubble in 2003 to the next bubble pop in 2008; the wait from

2008 to 2021 has been excruciatingly long. Thirteen years we've had to wait for the retail

herd to go all in, for margin debt to soar to new extremes, for short interest to fall to

multi-decade lows.

But it's finally showtime, and the bagholders continue buying garbage that's guaranteed to

collapse in value. The post-bubble-crash phase is already being prepared:

no one could have seen this coming--except anyone who paid attention to anything other

than self-interested shills.

The woe and gnashing of teeth will be colossal for the bagholders, as will the profits for

Wall Street insiders. Fortunately they have long practice in looking woeful in public,

as if they're sharing the pain, and hiding their glee at getting away with

the same old "this isn't a bubble" scam yet again.

What nobody dares ask is: will the bagholders have anything left after this "third time's

the charm" bubble pops? Please don't tell us this is the end of the road for the

"this isn't a bubble" scam. Without greed-fueled credulous bagholders with cash/credit to

gamble, the game is over.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

My new book is available!

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

20% and 15% discounts (Kindle $7, print $17,

audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Videos/Podcasts:

Gadfly Interview with Charles Hugh Smith (Host Carlos Gonzalez, 22 min)

My COVID-19 Pandemic Posts

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

($5 (Kindle), $10 (print), (

audiobook):

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake

$1.29 (Kindle), $8.95 (print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print)

Read the first section for free (PDF).

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, George A. ($54), for your marvelously generous contribution to this site -- I am greatly honored by your support and readership. |

Thank you, Denise S. ($5/month), for your superbly generous pledge to this site -- I am greatly honored by your steadfast support and readership. |

|

|

Thank you, Rob S. ($50), for your magnificently generous contribution to this site -- I am greatly honored by your support and readership. |

Thank you, Amber ($5/month), for your splendidly generous pledge to this site -- I am greatly honored by your support and readership. |