The Housing Bubble: Owners Trapped by Low-Rate Mortgages, Buyers Thwarted by High-Rate Mortgages

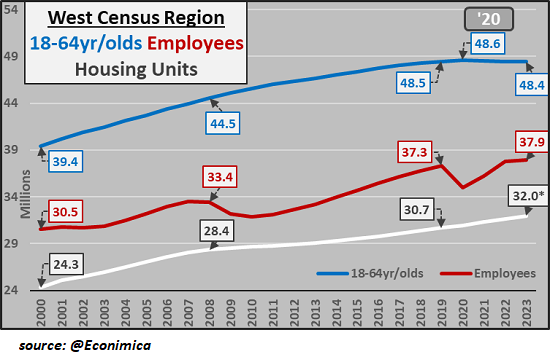

Who's left to buy overvalued houses? Too few to prop up bubble valuations

If as many posit the Federal Reserve has an unstated mandate to generate a "wealth effect" by propping up housing, they've managed to create a no-win situation. As longtime correspondent K.M. recently documented, roughly half of the 50+ million home mortgages in the US were refinanced in 2020 and 2021 to lock in historically low interest rates of less than 4%, with many around 3%.

Closed-end originations (excluding reverse mortgages) increased in 2020 by 65.2 percent, from 8.3 million in 2019 to 13.6 million in 2020.

Almost 25% of homeowners refinanced in 2021.

About half (51%) of homeowners have a rate under 4%.

As K.M. observed:

"That doesn't include the millions who bought houses 2020 - 2021 at rates below 4%, who similarly are unlikely to sell unless rates drop well below 5%. Those who got rates below 3% or thereabouts, may be permanently off the market.

Think about it - why would I sell and surrender a 2.75%, 3.00% or 3.25% 30-year mortgage, only to move into another house with a loan at 5.5% - 6.5%? I'm locked into my house and loan for years if not decades.

And then there are reverse mortgages, which essentially lock the elderly in their houses for life. That's been a housing stock reduction force for years now and may explain the increase in the number of houses in obvious disrepair.

I think you can see where I'm going with this. The artificially low rates of 2020 - 2021 have at least semi-permanently (and permanently in millions of cases) removed many millions of housing units from the market."

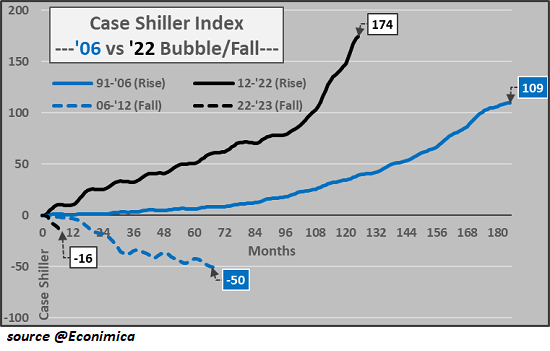

We all know what happened to housing valuations as mortgage rates plummeted and post-pandemic panic-buying swept through the market: valuations skyrocketed, pushing housing affordability to near-record lows. (See chart below of the Case-Shiller Index which shot up from below 100 to 174 in the 2020-2022 bubble mania.)

This was not "market forces"--this was outright intervention by the Federal Reserve and federal housing agencies.

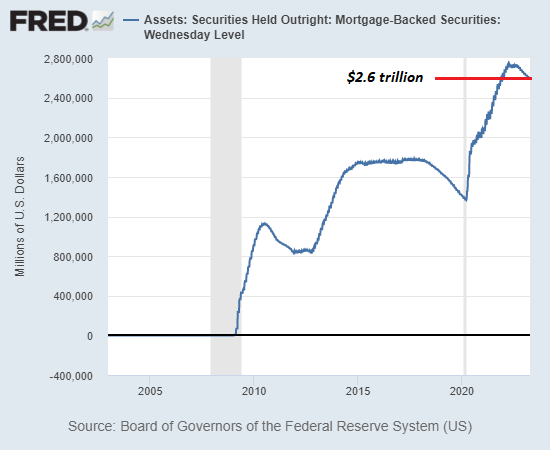

As the chart below of mortgage-backed securities (MBS) held by Federal Reserve banks shows, the Fed went from owning zero MBS prior to the bursting of the first housing bubble in 2007-08 to owning roughly 20% ($2.6 trillion) of the entire US mortgage market for conventional single-family homes: ($13 trillion).

Federal agencies such as the Federal Housing Administration (FHA) and Veterans Administration (VA) offer low-down payment mortgages and other incentives. The mortgage-backed securities are guaranteed by Fannie Mae, Freddie Mac, or Ginnie Mae, quasi-governmental agencies. The entire state-central-bank financial machinery has worked together to inflate a housing bubble that makes those who bought long ago feel wealthy while making housing unaffordable to younger buyers who don't have the luxury of getting help from wealthy parents.

So the Fed has succeeded in inflating a housing bubble that makes the already-wealthy feel even wealthier, but only by throwing the younger generations of potential homeowners under the bus. As I have argued here,

(Why Interest Rates Are Not Going Back to Zero), the risk profile of the global economy and financial system has changed, and this risk is repricing the cost of capital (interest rates) and all financial assets.

K.M. summed it up thusly:

"The whole problem with housing in the past several decades has been the manipulation of the market by government players - The Fed, HUD, FNMA/FHLMC, and the other alphabet-soup agencies that rule the housing market. It has far less to do with natural demand and supply than is commonly believed. I'm saying this as one who worked in the mortgage business for many years."

Unless the Fed is going to buy up the entire $13 trillion mortgage market, market forces will keep mortgages rates in the historical range of 5% to 7%.

Meanwhile, those with 3% mortgages are trapped in their current homes which are effectively off the market, and would-be young homeowners face the unaffordable combination of bubble-valuations and high mortgages rates.

As I concluded in my previous commentary on the housing bubble (This Housing Bubble Is Different: It's Much More Precarious),

Distortions eventually have consequences. Concentrate wealth and income in the top 5% and corporations, and give the already-wealthy abundant low-cost credit to concentrate ownership of assets, and you get a distorted economy in which the older and wealthier have outpriced the young.

Who's left to buy overvalued houses? Too few to prop up bubble valuations. This Fed-engineered generational wealth-opportunity inequality will generate more than a phantom "wealth effect"--it will also generate second-order effects of social fragmentation and the erosion of the social contract that the Fed is powerless to repair.

New Podcast:

Turmoil Ahead As We Enter The New Era Of 'Scarcity' (53 min)

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Karen K. ($100), for your outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Doug W. ($10/month), for your outrageously generous pledge to this site -- I am greatly honored by your steadfast support and readership. |

|

Thank you, Josiah B. ($1/month), for your most generous pledge to this site -- I am greatly honored by your support and readership. |

Thank you, James R. ($50), for your stupendously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |