12 Ways to Cut the Chains of Financial Serfdom

Just because nobody talks about financial serfdom doesn't mean it's not real.

Ours is a neofeudal economy of financial serfs in servitude to a Financial Aristocracy. The Financial Nobility / Aristocracy own all the debt and the serfs owe the debt to the Aristocracy. The serfs own assets that don't generate much income, the Aristocracy owns assets that generate trillions of dollars in income. The serfs pay high tax rates if they make above-poverty wages, the Financial Nobility pay low taxes thanks to tax-avoidance scams arranged by the Aristocracy's toadies and lackeys in the Central State. The serfs create value, the Financial Nobility is parasitic.

That we are powerless is one of the key social control myths constantly promoted by

the Status Quo. What better way to keep the serfs passive than to reinforce a belief in

their powerlessness against Financial Feudalism?

But we are not powerless. Our complicity gives the Financial Aristocracy its power. Remove

our complicity and the Aristocracy implodes.

The pathway of liberation is to opt out of financial feudalism. Here are twelve paths any adult can legally pursue in the course of their daily lives:

1. Support the decentralized, non-market economy. The core ideology of consumerism and financialization is that non-market assets and experiences have no status or financial value. This includes social capital, meals with friends, projects done cooperatively with friends, home gardens and dozens of other decentralized activities that cannot be financialized into centralized market transactions. Identity and social status are established in the non-market economy by collaboration, sharing, reciprocity, conviviality and generosity.

Decentralized means localized; farmers markets are examples of local market economies where the transactions are in cash (so banks can't skim transactions fees) and the money stays in the local economy rather than flowing to some distant concentration of capital.

If you start valuing non-market assets and experiences as the most important markers of status, you are resisting both financialization and consumerism.

Top-down centralized "solutions" imposed by the Central State are the problem, not the solution, as they further the concentration of wealth and power into unstable monocultures. Stop looking to overly complex fake-reforms and centralized solutions to unsustainable systems and start exploring decentralized, localized solutions that bypass both the Central State and the Financial Aristocracy.

2. Stop participating in financialization. Financialization is the insidious imperative of the Financial Aristocracy that seeks to turn every human interaction into a financial transaction that can be charged a fee, and transform all assets into financialized instruments that can be commoditized and sold for immensely profitable fees.

As the finances of local governments implode under the weight of their protected fiefdoms, many are heeding the siren song of financialization as a temporary (and inevitably disastrous) "fix" to their structural insolvency. For example, the revenue stream from parking meters is financialized into an asset that is sold to a private corporation. When parking fees double, the residents of the city have no recourse via democracy or petition, as the meters in their city are now "owned" by a distant concentration of capital that can double late fees, charge outrageous transaction costs, etc., at will.

This is how financialization inevitably transitions into financial tyranny.

The erosion of America's middle class security has several structural causes, but chief among them was the financialization of the housing market. This has led to serial bubbles of housing valuations and the widespread extraction of equity for consumption--the classic "windfall" that financialization always produces in its first toxic blush.

3. Redefine self-interest to exclude debt-servitude and dependence on consumerism

and the Central State. Unless you are long retired and have no other option, minimize reliance on the State. Reliance on the State weakens the correlation between sustained effort and gain, so the work ethic and entrepreneurism both atrophy as they no longer offer competitive advantages in a system where bread and circuses are guaranteed by the State.

4. Act on your awareness that the nature of prosperity and financial security is

changing. Dependence on centralized concentrations of power (Wall Street and the Central State) is now an extremely risky wager that what is demonstrably unsustainable will magically become sustainable via pixie dust or more Federal Reserve trickery. Security flows from resilience, self-reliance, decentralized, diversified sources of income and abundant social capital, not speculation fueled by Fed policies and Wall Street.

5. Stop supporting distant concentrations of capital that subvert democracy by

using their gargantuan profits to buy the machinery of State governance and regulation. For example, stop watching broadcast programming owned by the six global media corporations that control the vast majority of the media/marketing complex.

Stop eroding your health and sending your money to corporate headquarters by no longer frequenting fast-food restaurants and by no longer buying unhealthy packaged foods from corporate agribusiness.

Close your accounts with Wall Street investment firms and the "too big to fail" banks that dominate the mortgage, credit and debt markets in the U.S. If you need such an account to transact your business, maintain low balances so the banks cannot sweep your capital for their own use every day.

6. Stop supporting the debt-and-leverage based Financial Aristocracy. Liquidate all debt as soon as possible, take on no new debt except for short periods of time, explore localized or crowd-sourced private-capital loans that exclude the banks and limit the number of financial transactions that enrich the banks and Wall Street.

7. Transfer your assets out of Wall Street and into local enterprises or

assets that do not enrich and empower Wall Street. Buy assets you control 100%, without the mediation of Wall Street.

8. Refuse to participate in consumerist status identifiers and the social defeat

they create. Stop admiring and respecting those displaying status signifiers (supercars, $300 million yachts, etc.); start thinking of them as pathetic prisoners of a pathological mindset. Stop judging people based on their lack of status signifiers. Free your own mind from the toxic sociopathology of consumerism and social defeat. Stop watching commercial television and streaming corporate distractions and minimize your exposure to marketing and consumerist propaganda.

9. Vote in every election with an eye on rewarding honesty and truth and punishing

empty promises. Unless the incumbent has renounced corporate contributions, unsustainable debt, financial tyranny and Central State encroachment of civil liberties, then vote against the incumbent, for they are just another lackey of the State-Plutocracy partnership. Avoid voting for either the Demopublican or Republicrat branches of the plutocracy; vote for an independent or third party candidate.

Remember that resistance isn't just about refusing to participate in pathological neofeudalism; it’s about establishing a sustainable alternative to the unsustainable

State-Aristocracy partnership. When people say that voting for a third-party candidate is "wasting your vote," reply that voting for either of the plutocrat parties is the real waste of a vote because their "leadership" is dooming the nation to destabilization and insolvency. As independents pick up more and more "wasted" votes, they shift from being "marginalized" to becoming powerful voices of integrity and transparency.

10. Stop supporting inflationary policies such as money creation - QE by the Federal

Reserve and Federal deficit spending. Act on your knowledge that inflation is theft and that the Federal Reserve is a private consortium of banks that is the enabler and protector of the parasitic Financial Aristocracy.

11. Become healthy, active and fit. Refuse to consume unhealthy junk food and packaged food, refuse to squander much of your time in sedentary "consumption" of corporate "entertainment" and digital distraction, and devote your energy and time to mastery, new skills, developing social capital and friendships, projects you own and enterprises that benefit your true self-interest. Refuse to follow the marketing/media siren song into chronic ill-health, social-media addiction and social defeat.

12. Embrace self-directed plans and construct a resilient, community-based, localized

life of identity and meaning. Build a social ecology of positive, productive, collaborative, non-pathological people of like minds and spirits. Be powerful via

Self-Reliance, not powerless via apathy, passivity and complicity.

For more on these ways to break free of serfdom, check out my books

Resistance, Revolution, Liberation: A Model for Positive Change,

An Unconventional Guide to Investing in Troubled Times

and

Self-Reliance in the 21st Century.

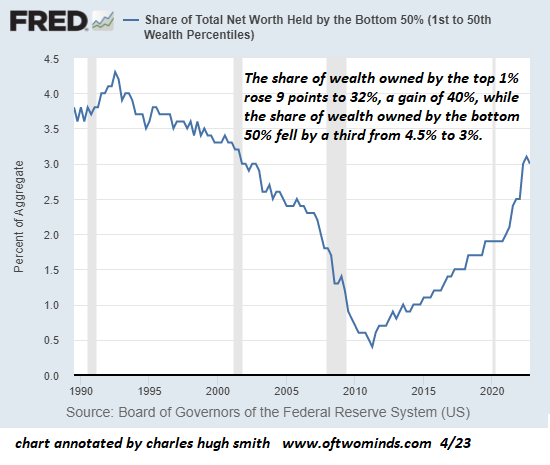

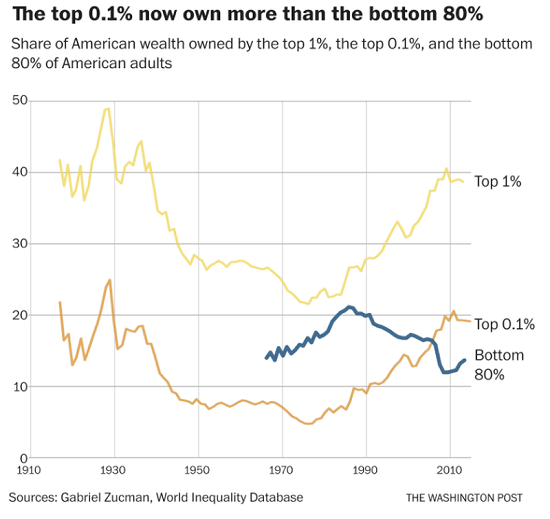

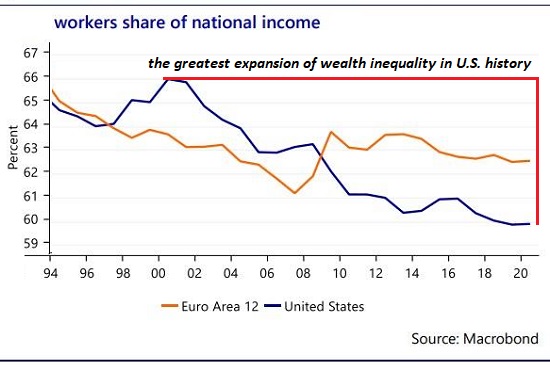

Here is Neofeudal Financial Serfdom in three charts: just because nobody talks about neofeudalism doesn't mean it's not real:

New Podcast:

Charles Hugh Smith on Getting Ready for a Real Recession (38 min) (38 min)

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, David E. ($60), for your monumentally generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, John G. ($10.80), for your most generous contribution to this site -- I am greatly honored by your support and readership. |

|

Thank you, John L. ($5/month), for your splendidly generous pledge to this site -- I am greatly honored by your support and readership. |

Thank you, Scott C. ($54), for your magnificently generous contribution to this site -- I am greatly honored by your steadfast support and readership. |