How to Navigate Our Low-Trust, Increasingly Dysfunctional Society and Economy

Politicians and corporate managers have an enviable record of self-enrichment but very little to show in terms of putting the long-term interests of the citizenry above their own short-term gains.

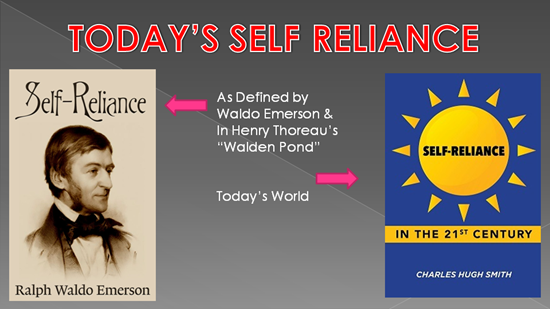

This week's focus is on self-reliance, a topic of increasing relevance than is more complex that it may seem.

Sociologists differentiate between high-trust and low-trust societies: in high-trust social orders, citizens tend to trust institutions and each other to conform to social norms, enabling strangers to trust a vast circle of transactions and socio-economic ties. Low-trust societies are plagued with distrust of authority and institutions and fear of getting taken advantage of by strangers, so the circles of trust are small, inhibiting social mobility and economic growth.

Economies and political systems can also be understood as high-trust or low-trust. If the political system excels at rewarding insiders and incumbents while leaving critical problems unsolved, citizens have little reason to trust the system.

The same is true of economies that greatly enrich insiders and incumbents at the expense of the citizenry via monopoly/cartel price-gouging, shrinkflation, degrading the quality of goods and services and the immiseration of standard services, forcing customers to "upgrade" from wretched to merely dismal.

Conventional pundits and economists are constantly whining that Americans "just don't get it": they tout our soaring per capita wealth, i.e. we're getting richer, so everyone should be delighted, yet only 20% of the public are "satisfied with the way things are going."

What the well-compensated pundits and economists are ignoring (or are paid to ignore) is the decay of the U.S. from a high-trust-functional to a low-trust-dysfunctional society and economy: Americans will still go out of their way to aid strangers, but their trust in institutions has plummeted to lows, as has their trust in the political-corporate elites' leadership: politicians and corporate managers have an enviable record of self-enrichment but very little to show in terms of putting the long-term interests of the citizenry above their own short-term gains.

People understand the name of the game now is to spout all the expected optimistic PR of "innovation" and "serving the public" while maximizing their private gain at the expense of the nation. Offshoring America's essential industrial supply chains wasn't done to serve the nation; it was done to maximize profits, 90% of which flow to the top 10%. Pushing us into debt servitude is highly profitable, but it isn't benefiting us or the nation.

Americans were told to trust long, hyper-globalized single-source supply chains as "efficient" (i.e. profitable) and trustworthy, yet they've discovered these supply chains are vulnerable and fragile. Americans were told that corporate monopolies were selling them "innovations" when in fact they were being sold highly addictive (and therefore highly profitable) goods and services.

Americans were told that their financial security was increasing even as the U.S. economy became increasingly dependent on hyper-financialized asset bubbles and central bank bailouts, the precise opposite of stability. Rather than producing more financial security for the bottom 80%, these "innovations" greatly expanded the gulf between the wealthy and the increasingly precarious bottom 80%.

Americans were told to trust that the hyper-centralization of political and financial power would benefit them, when the evidence is piling up that this hyper-centralization has increased the dysfunction of core institutions and the fragility of essential systems.

Doesn't it ring hollow to glorify our soaring wealth while households declare bankruptcy due to medical bills, college students sign up for a lifetime of debt servitude to pay tuition and inflation has destroyed 20% of every wage earner's paycheck just since January 2020? All that "soaring wealth" is asymmetrically distributed, but let's not talk about that, let's talk about statistics that mask that asymmetry.

What the well-compensated pundits and economists are paid to ignore is the concentration of the vast majority of all this new wealth and income in the top 10%. Soaring wealth only widens wealth inequality; it doesn't benefit the nation, it weakens its foundations by accelerating the decay of trust in core institutions and systems.

What happens when high-trust decays to low-trust is the circle of reliable, trustworthy sources and people shrinks to the local, decentralized level. Rather than trust Big Ag, Big Fast-Food and supply chains of highly processed glop to feed us, we start turning to local sources of real food.

In the same way, we rediscover the value of thinking for ourselves rather than accepting self-serving memes-of-the-day. We rediscover the value of what Ralph Waldo Emerson wrote about in his 1841 essay

Self-Reliance (free text, Project Gutenberg).

Emerson counsels us to "be our best selves," and not to count property wealth above all else. ("They measure their esteem of each other by what each has, and not by what each is.")

Emerson understood that the values of a society are the foundation of its economic order. A system lacking any principles and values other than greed and self-enrichment is a rotten structure doomed to collapse. It is not just the larger socio-economic order that needs a rock-solid value system; each individual must ground their choices and actions in a value system they have embraced on their own.

("Nothing can bring you peace but yourself. Nothing can bring you peace but the triumph of principles.")

What Emerson is espousing is self-reliance, in thought, in values, and in economic and financial matters. In today's world of crumbling hyper-globalization, self-reliance extends to the practical world of where our essential goods and services are coming from.

Gordon Long and I discuss these and many other aspects of Self-Reliance in the 21st Century in our wide-ranging podcast

Self Reliance (45 min).

We discuss how the American economy has changed over the past 40 years, to the detriment of the nation's values and the security of its citizenry, and what self-reliance means today-- the topic of my book

Self-Reliance in the 21st Century. (Read the first chapter for free.)

How can we best navigate our low-trust, increasingly dysfunctional society and economy? By strengthening our own self-reliance.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Matt ($50), for your splendidly generous Substack contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Damion M. ($5/month), for your marvelously generous Substack contribution to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, Cootzer ($50), for your superbly generous Substack contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Tim B. ($50), for your magnificently generous Substack contribution to this site -- I am greatly honored by your steadfast support and readership. |