What If All the Conventional Models Fail to Predict What Happens Next?

The 'novel, apocalyptic situation which has now arisen' goes largely unrecognized.

A truly staggering quantity of content is aimed at predicting what happens next, a.k.a. the future, and justifies their prediction by referencing models that are presented as rock-solid predictive tools. The majority of these models are based on historical examples that have been distilled into models of "how the world works," i.e. claims that these were not one-offs or outliers but examples of dynamics that will play out tomorrow as they played out 10 years ago, 100 years ago or 1,000 years ago.

History is complex and thus open to interpretation. The victors / survivors write the histories to suit their interests (protecting their reputation, covering their errors, etc.) and historians who follow gather new bits of information and then present a new interpretation that inevitably reflects the zeitgeist of their era.

Those hazarding predictions typically start with a model (Keynesian economics, for example) and then seek data to support their model of choice. It is relatively rare for an analyst to start with a mass of often incomplete and contradictory data points and hazard a prediction about what happens next without proposing a model, for without a theoretical model, skeptics can quickly claim the data was nothing more than a one-off and therefore of little predictive value.

This is how we become so wedded to models that we defend them vociferously. Without a model, then history quickly decays into one damn thing after another, i.e. quasi-random events devoid of causal patterns. Since our desire to piece together causal chains as the means to develop predictive tools is innate, we seek universal models of how the world works, even if the data is scarce and our understanding is limited.

Lacking evidence and understanding of invisible dynamics, we conclude thunder means the gods are angry, and so our response is to make a sacrifice and beg the gods' forgiveness.

We tend to think we've risen so far above such causal errors that our understanding is now essentially god-like. That our models are proven goes without saying, and the only debate is which model will be more successful in predicting

what happens next.

But suppose none of our models are actually as predictively useful as we imagine. Suppose the Keynesian economic model will completely miss the mark, and following that model is simply doing more of what's failed. Perhaps competing models will come up short as well.

The possibility that all of our models will fail to accurately predict what happens next rarely occurs to us, for it moots the entire project of making accurate predictions and mapping our responses. If we admit the possibility that the next few years cannot be accurately predicted for a variety of reasons, then our Plans A, B and C (and our own thinking) must necessarily be contingent and flexible.

We must be willing and able to throw overboard our entire edifice of models, data and expectations, and respond without any confidence in the models we wedded and are loathe to surrender. This is difficult for us because it demands capacious stores of humility and a willingness to say "I was wrong, the models I've staked my entire career on are incorrect."

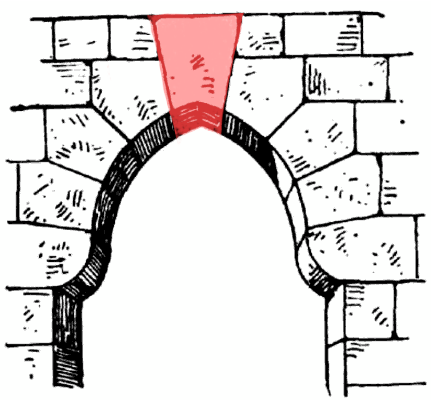

Consider the keystone's role in arches and ecosystems. We understand that removing the keystone from the arch causes the arch to collapse, but we're stunned when removing a species from an ecosystem collapses the ecosystem because we did not recognize the species was the keystone species of that self-organizing system: without that species doing its part, the whole system collapses.

Our ability to discern the many keystones in sprawling, complex systems is not as god-like as we imagine. This is the source of the multi-century debate about what caused the western Roman Empire to collapse. Like many others, I have often referenced the decline and eventual collapse of the western Roman Empire in my work, with the caveat that I don't propose any one cause was the sole keystone that when removed, collapsed the entire empire.

Based on my reading of various authors, it seems the empire was beset by what we now call a polycrisis, a set of independent crises that fed back into one another, exacerbating the overall situation from one that the empire could have managed, with sufficient time and effort into one that overwhelmed the remaining Imperial resources.

New aspects of the polycrisis continue to come to light. In

The fall of the Roman Empire: a new history of Rome and the Barbarians, author Peter Heather argues that the Roman Empire was not on the brink of social or moral collapse, what brought it to an end were the so-called Barbarians gaining the expertise to field large armies from their Roman neighbors.

But it's impossible to dismiss the other material factors described by author Kyle Harper in The Fate of Rome: Climate, Disease, and the End of an Empire. Climate change that reduces crop yields and pandemics that kill a third of your armies and populace can ruin your day to the point that the Barbarians who suffered fewer losses due to their more widely dispersed villages had the upper hand regardless of other conditions.

My point here is that each of these causal chains ran through systems which each had a keystone. There wasn't just one keystone that supported the weight of the entire empire; there were keystones in a vast range of systems, each of which was itself a keystone in the entirety of the empire.

This is why I doubt any of the predictions about what happens next in the global and US economies, geopolitics, etc. will prove accurate. Every prediction is based, explicitly or implicitly, on a model with shaky foundations and therefore shaky causality, a model that fails to identify the keystones in each complex subsystem that makes up the system the model is modeling.

I have quoted from Michael Grant's succinct book The Fall of the Roman Empire many times, for it strikes me as the keystone of insight into western Rome's collapse: the elite's complacent belief in Rome's eventual success and their inability to recognize the novel challenges they faced.

"Enmeshed in classical history, all he can do is lapse into vague sermonizing, telling the Romans,

as many a moralist had told them throughout the centuries, that they must undergo an ethical

regeneration and return to the simplicities and self-sacrifices of their ancestors.

There was no room at all, in these ways of thinking, for the novel, apocalyptic situation which

had now arisen, a situation which needed solutions as radical as itself. His whole attitude is

a complacent acceptance of things as they are, without a single new idea.

This acceptance was accompanied by greatly excessive optimism about the present and future.

Even when the end was only sixty years away, and the Empire was already crumbling fast, Rutilius

continued to address the spirit of Rome with the same supreme assurance.

This blind adherence to the ideas of the past ranks high among the principal causes of the downfall

of Rome. If you were sufficiently lulled by these traditional fictions, there was no call to take

any practical first-aid measures at all."

And so here we are, wandering from room to dust-choked room, every one stuffed to the ceiling with predictions based on blind adherence to the ideas of the past presented as "scientific" because the data has been neatly organized and the adherents are so confident in the correctness of their diagnosis and proposed cure.

The novel, apocalyptic situation which has now arisen goes largely unrecognized. The technical-managerial experts all share a complacent acceptance of things as they are, without a single new idea, as their confidence in their models is so great that there is no need for new ideas.

Show me the keystones in each subsystem of a highly complex, tightly bound system, and then maybe we'll have a few hints about what happens next. Rather than pile up more predictions, it might be wiser to start stocking up humility and preparing to jettison all the old models and solutions before they sink the lifeboat.

Author's note: most of the time when I write an essay that I consider important, it attracts little attention and 'falls stillborn from the press,' in David Hume's phrase. This is one of those essays.

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Wayne K. ($100), for your most generous subscription to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Gregg S. ($7/month), for your superbly generous subscription to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, Robert H. ($70), for your magnificently generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Ron H. ($70), for your splendidly generous subscription to this site -- I am greatly honored by your support and readership. |